Peer-to-peer exchanges are allowing a growing number users to buy bitcoin and other cryptocurrencies directly with each other, without any middlemen.

For anyone looking to buy their first bitcoin or any other cryptocurrency, the most apparent next step is to sign up for a centralized exchange like Coinbase or Binance.

However, like most intermediaries, centralized exchanges come with a large set of downsides. While being highly convenient, you give up control over the private keys to your coins and find yourself at their mercy when it comes to withdrawals.

If you’ve ever bought something just to realize then that you couldn’t withdraw when you wanted, you'll know what I’m talking about. Centralized exchanges will often have a list of restricted countries, leaving traders in those places without means to buy crypto.

An effective alternative to using centralized exchanges or DEXs (decentralized exchanges) are peer-to-peer (P2P) exchanges.

How do P2P exchanges work?

As the "peer-to-peer" name indicates, buys and sells are initiated directly between two parties without any third parties or central governance on the platforms. Some peer-to-peer exchanges run entirely on automated protocols and smart contracts.

On centralized exchanges, like Binance, your orders will be added to an order book eventually to be filled by a market makers’ bot, while on peer-to-peer exchanges, a matching engine connects buyers and sellers.

Removing the human middlemen in the transaction, P2P exchanges are also usually more private than their centralized counterparts and enable more direct global trading.

What to look for in a P2P exchange

When searching for the best peer-to-peer exchange to trade bitcoin, there are a few key things to look out for:

- Safety measures: when trading on p2p exchanges, safety is more in the hands of users than on other platforms. Check if the exchange supports 2FA and has dispute resolution mechanisms and a way to address scams.

- Trading fees: depending on the volume you’re planning to trade, small percentages can make a big difference. Usually, fees are relatively low on p2p platforms ranging between 0% — 0.7%. On some platforms, fees only incur when you post an ad or put up an offer.

- Payment methods: You might want to use your local currency, or PayPayl, so check before you sign-up if the platform supports your desired payment method. Some p2p exchanges have a wide variety of methods, while others only support a few local currencies.

- Volumes: When it comes to volume, more is better. If the volume is high, it usually indicates a wide variety of offers, making it more likely that you’ll easily be able to execute your trade.

Now for the fun part, let's go through some of the most popular, trusted, and battle-tested peer-to-peer exchanges. As usual, there is no one-size-fits-all, and it's important to find one that works best for you.

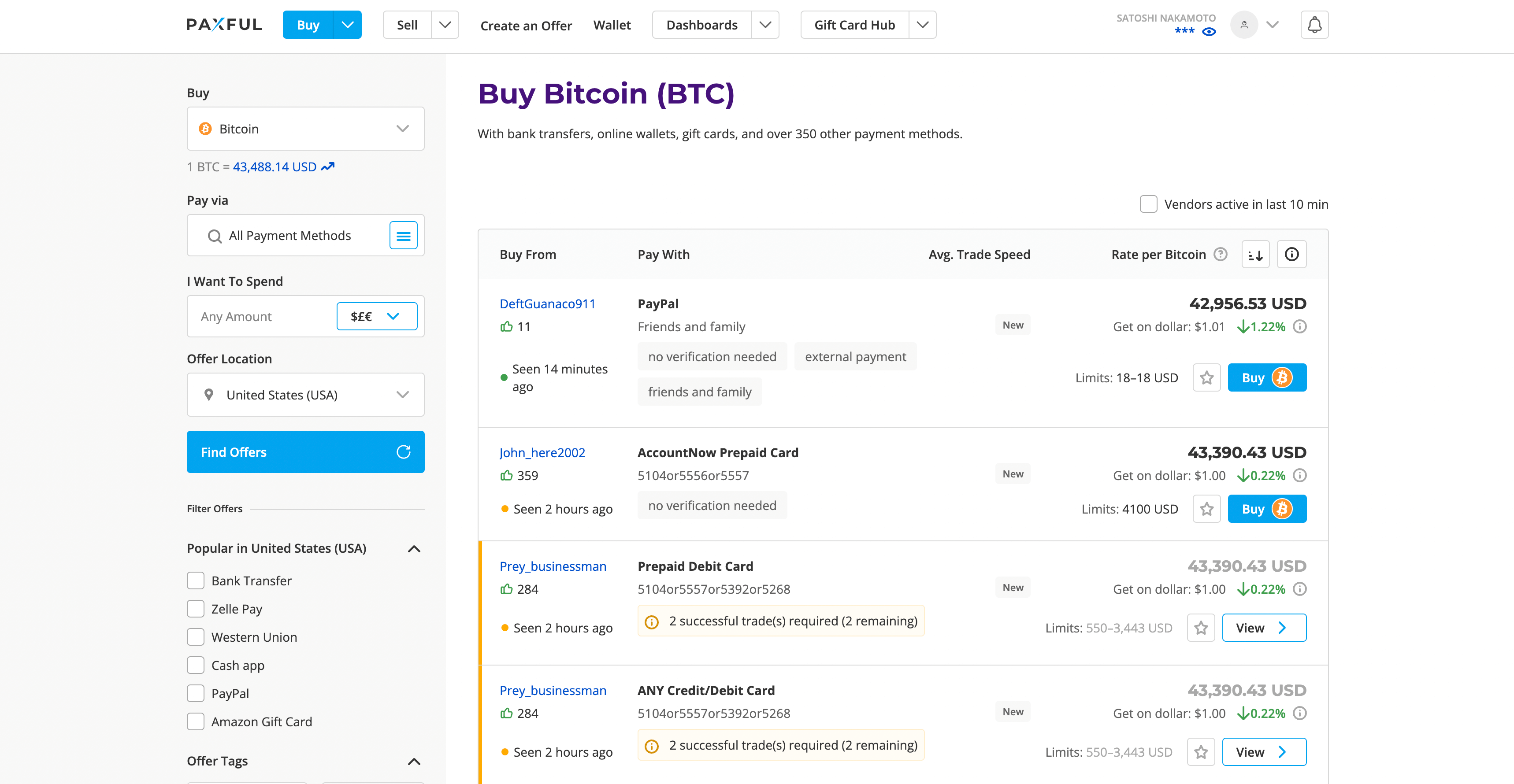

Paxful

Paxful is currently one of the most popular P2P exchanges. Founded in 2015 in Delaware, US by Ray Youssef and Artur Shaback, the platform has since grown to employ more than 200 people, spread to multiple cities across the globe.

Paxful describes its mission as becoming the “e-bay of the Bitcoin community.” On the peer-to-peer marketplace, users can meet online and trade Bitcoin. The platform offers more than 350 different payment methods, including more unusual things like iTunes cards or vouchers.

Paxful is hugely successful in Africa and boasts a relatively short list of restricted countries, including Burundi, Iran, North Korea, Syria, and Yemen.

With the reputation rating system on Paxful, users can quickly gain an understanding of the trustworthiness of their counterparty. Once the two parties have agreed on a trade, they will use the escrow service. The seller will deposit the Bitcoin into the escrow, and the buyer then has to pay using the agreed-upon payment method within a pre-specified timeframe.

Once both verify that all terms are met, the money is released to the sellers' wallet and the Bitcoin to the buyers.

In case of disagreements, Paxful's moderators are there to help resolve them and clamp down on any potential scammers. The fees on Paxful only apply to sellers who put up their offers. Currently, the fee stands at 1% + network fees for sending Bitcoin.

Overall, Paxful is a reliable, secure platform as long as one sticks to reliable sellers and doesn't take offers that are "too good to be true." 4.5 million people use Paxful, and with 4.6 stars on Trustpilot, the company is very well-received.

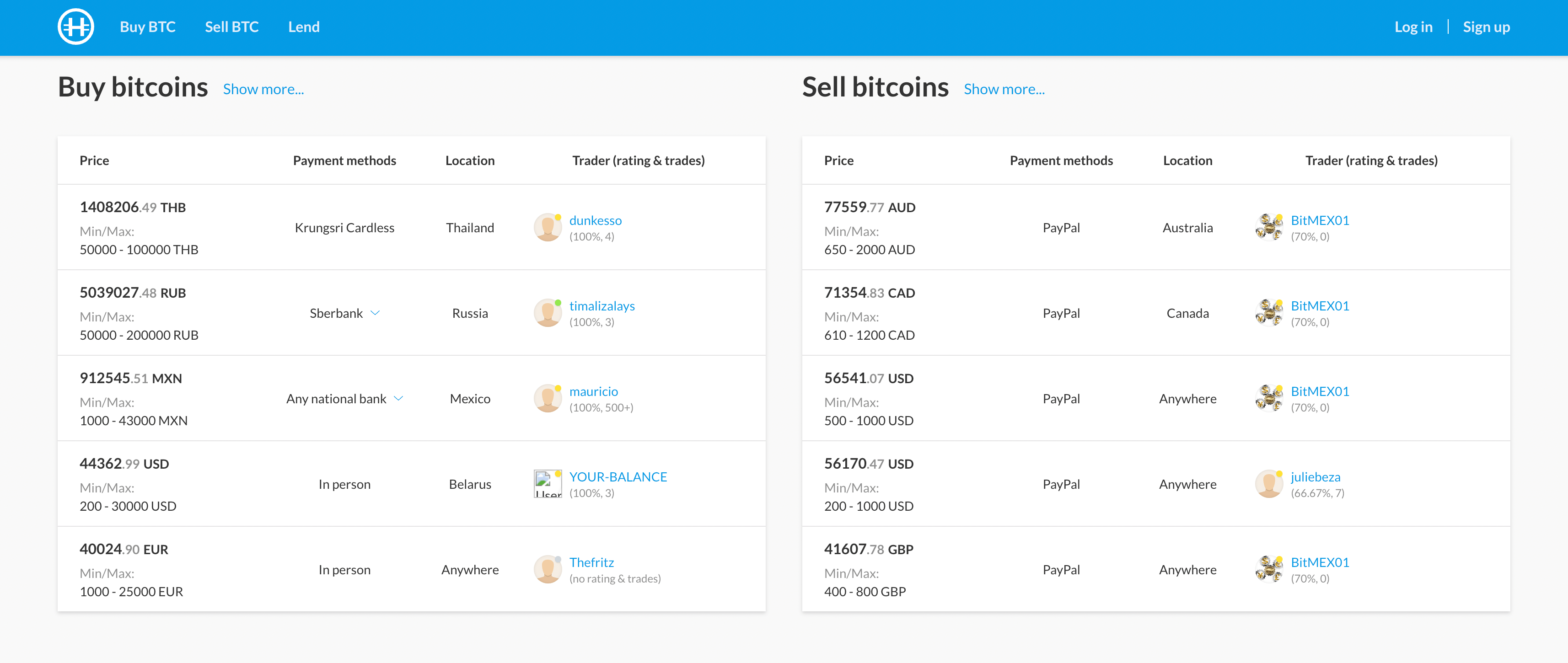

Hodl Hodl

Hodl Hodl is a global peer-to-peer trading platform launched in 2016. It facilitates trades between buyers and sellers without any middleman by locking funds into an escrow multi-sig.

Multi-sig stands for multi-signature and is a wallet/smart contract that only releases funds when certain conditions are met. On Hodl Hodl, conditions are met when both parties sign off on the trade.

Unlike other platforms, on Hodl Hodl, there is neither KYC nor AML enabling anyone to start trading after signing up with an e-mail address and a password.

When buyer and seller agree, the platform creates a multisig escrow bitcoin address; the buyer sends the fiat to the seller and deposits Bitcoin into the contract. It's released once the seller receives his money.

A unique feature that Hodl Hodl provides is their testnet, which users can use to try the entire process before actually putting any money into the platform.

By default, trading fees are 0.6% and lower for those who registered with a referral fee and those who verify. The fees are split equally between buyer and seller. On Trustpilot, the platform has 4.1 stars and might be perfect for those very fond of their privacy.

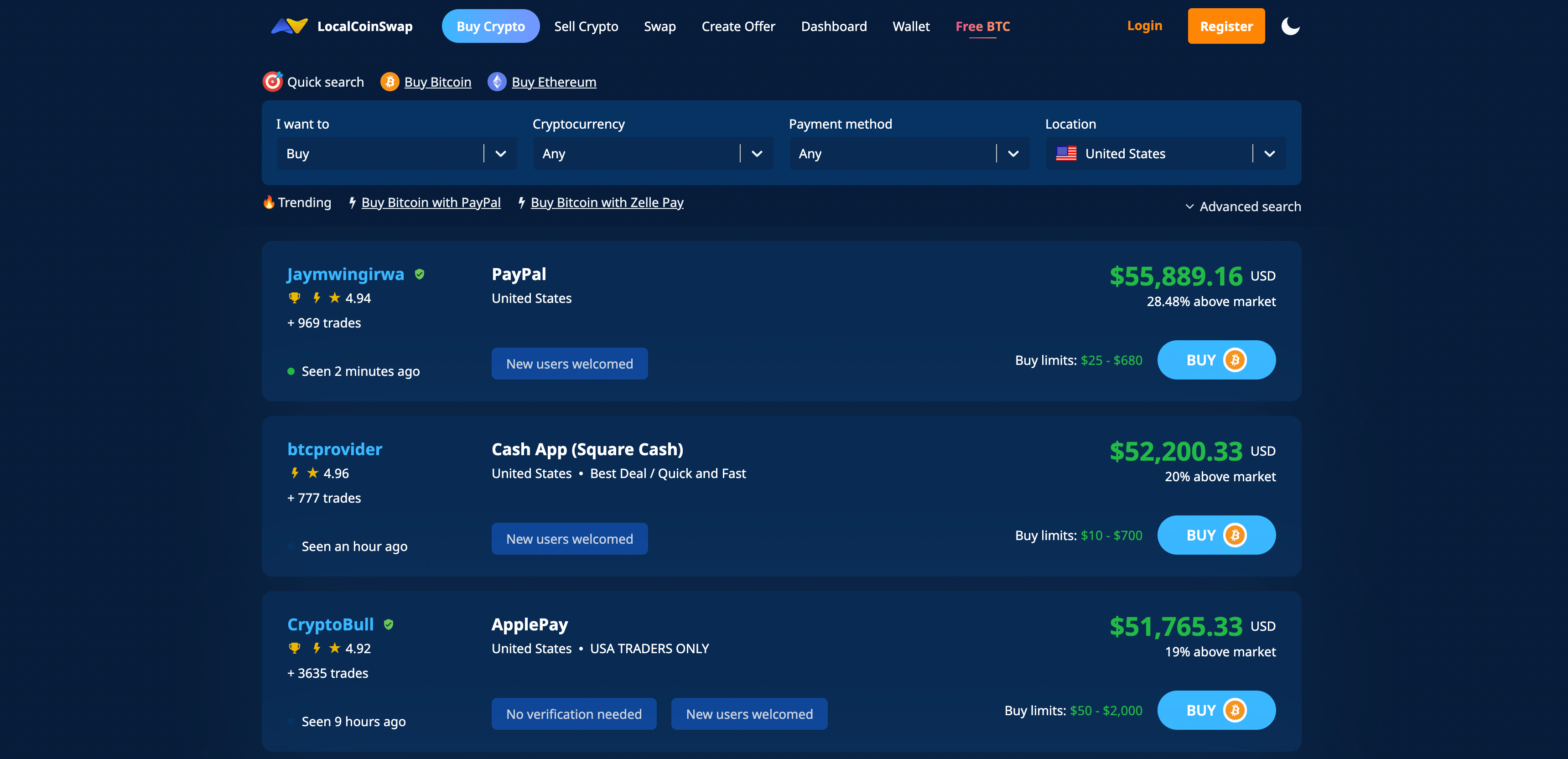

Local Coinswap

Local Coinswap is another peer-to-peer exchange with anonymous trading and low-fee trading. There is no minimum deposit amount, and users can pay using more than 300 different payment methods, including PayPal, wire transfer, and crypto. The platform supports 190 local currencies and facilitates $20 Million in trading volume.

Launched in 2018, Local Coinswap provides custodial and non-custodial trading for its customers on a wide range of cryptocurrencies, including Bitcoin, Ethereum, USDT, USDC, and more - a selection more colorful than most p2p exchanges.

Fees depend on how users enter a trade. When it's simply by responding to an already posted trade, there are no fees. This is the p2p exchange's way of encouraging users to fill existing trades before posting new offers. When posting an offer, traders are charged a 1% fee upon completion. Users can also refer to a reputation system to find out about their counterparty's previous trading history.

One thing to keep in mind when trading in a non-custodial manner is transaction fees, which can be considerable on ETH or ERC-20 coins.

In case of disputes, the support team is available to help deal with any problems. According to users on Trustpilot, it's a solid platform that has gained an average of 3.8 stars.

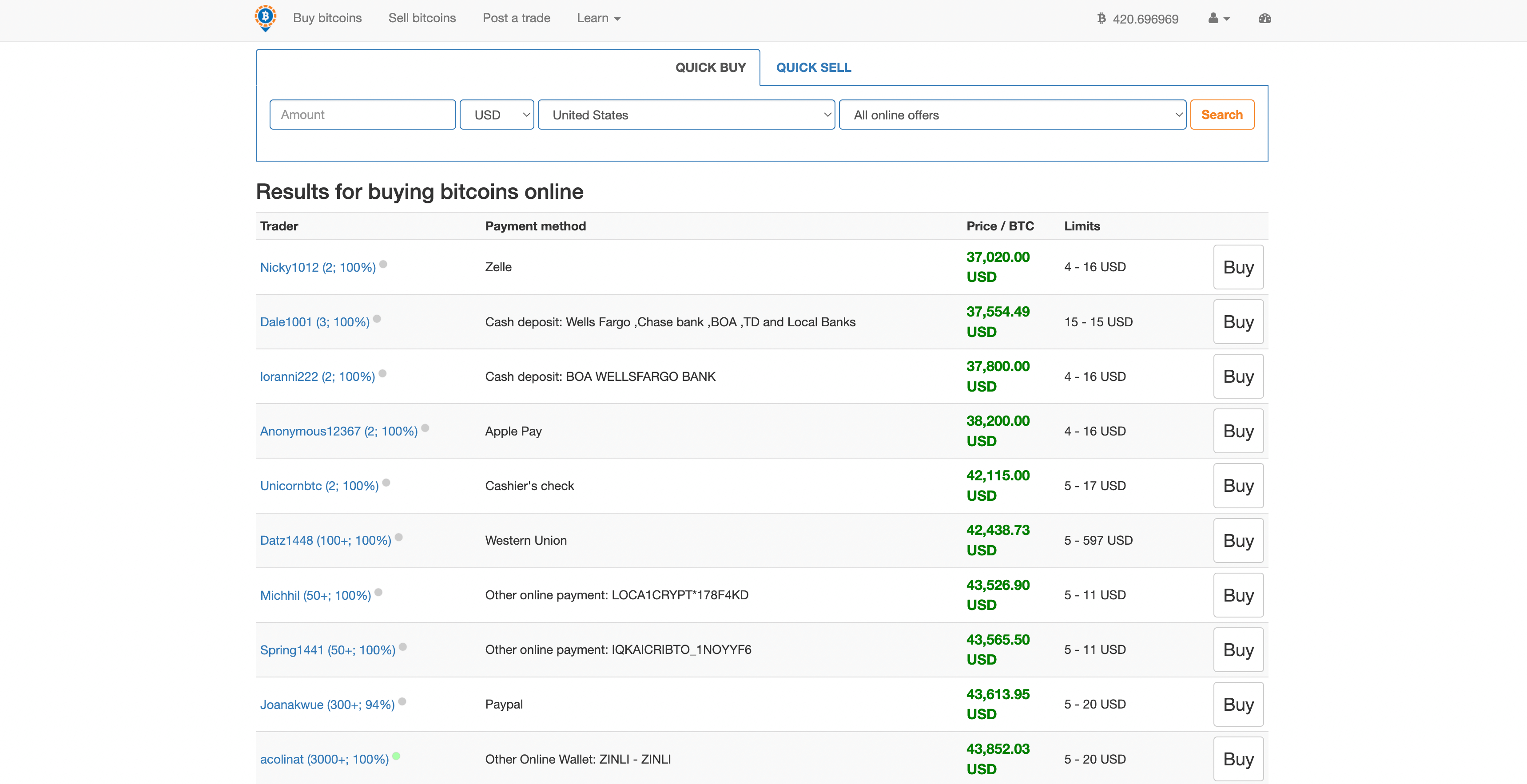

LocalBitcoins

LocalBitcoins was founded in 2012, long before many of us started investing in bitcoin and cryptocurrencies. Jeremias and Nicholas Kangas started the peer-to-peer exchange and ran it together until 2017. Since then, Sebastian Sonntag has taken over.

The platform facilitates trading in almost all countries and more than 7900 cities. LocalBitcoins is focused on building trust and supporting the widespread use of Bitcoin. As one of the oldest regulated p2p marketplaces, it requires users to get verified (KYC) before finding an offer.

For a peer-to-peer exchange with roughly one million users, LocalBitcoins provides decent liquidity and also offers the option to create ads for users to speed up finding another trader. Initially, LocalBitcoins even supported in-person meetings to settle in cash, but this option was banned in 2019. Accepted payment methods include cash deposits, bank transfers, and PayPal.

The only time a fee incurs is when users create an advertisement; in that case, the price is 1% of the trade once completed. Transactions between LocalBitcoins wallet users are entirely free.

When unsure if a counterparty is trustworthy, users can consult the forum to find others' reviews and any potential issues connected to a seller. While one of the oldest p2p platforms, the UI seems to be stuck a bit in the past decade.

However, it works smoothly, has a Trustpilot rating of 4.8 stars, and is a part of Bitcoin history.

Bisq

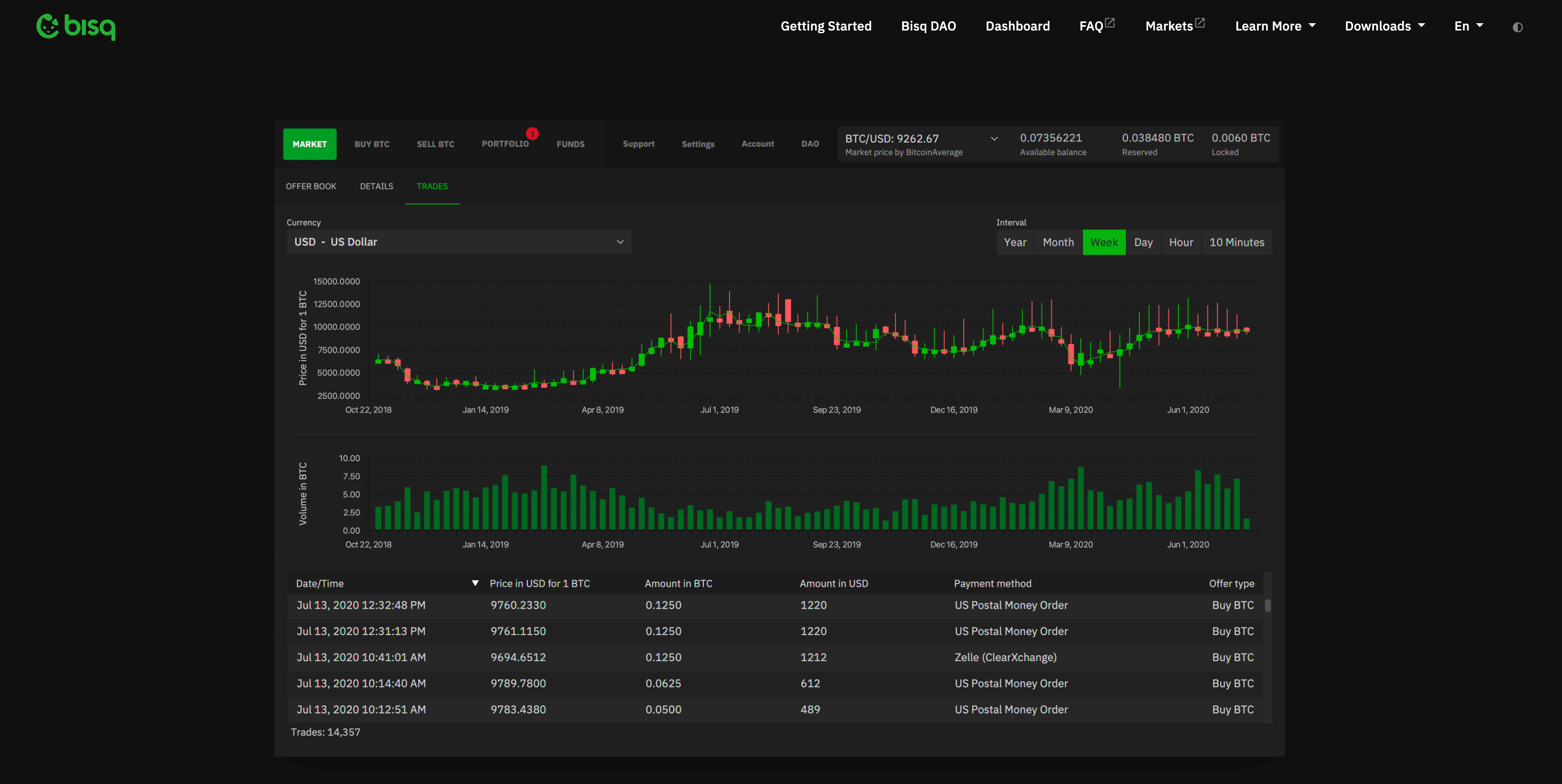

You can also try the very unique, open-source, and fully-decentralized exchange Bisq.

Bisq is software that is downloaded to your computer and allows for BTC trading with absolutely no KYC or identity verifications.

When using Bisq for trading, your bank won’t have any clue that you’re purchasing BTC, they will just see a transfer to another account. This means your bank will know where you sent the money to, so the government knows too if they want to, but at least no random centralized company will know.

If you prefer instant trades, Bisq, or any decentralized peer-to-peer exchange, is not really recommended. The platform works simply with one user setting up a bid/ask offer, and someone else taking it.

One disadvantage is the fact that there aren't currently enough users or volume on Bisq. This means low liquidity so as a seller you might have to drop significantly below market to find a buyer, and for a buyer, you might have to pay a premium.

If you plan on trading once or twice a week, Bisq is a great option for you.

Final Thoughts

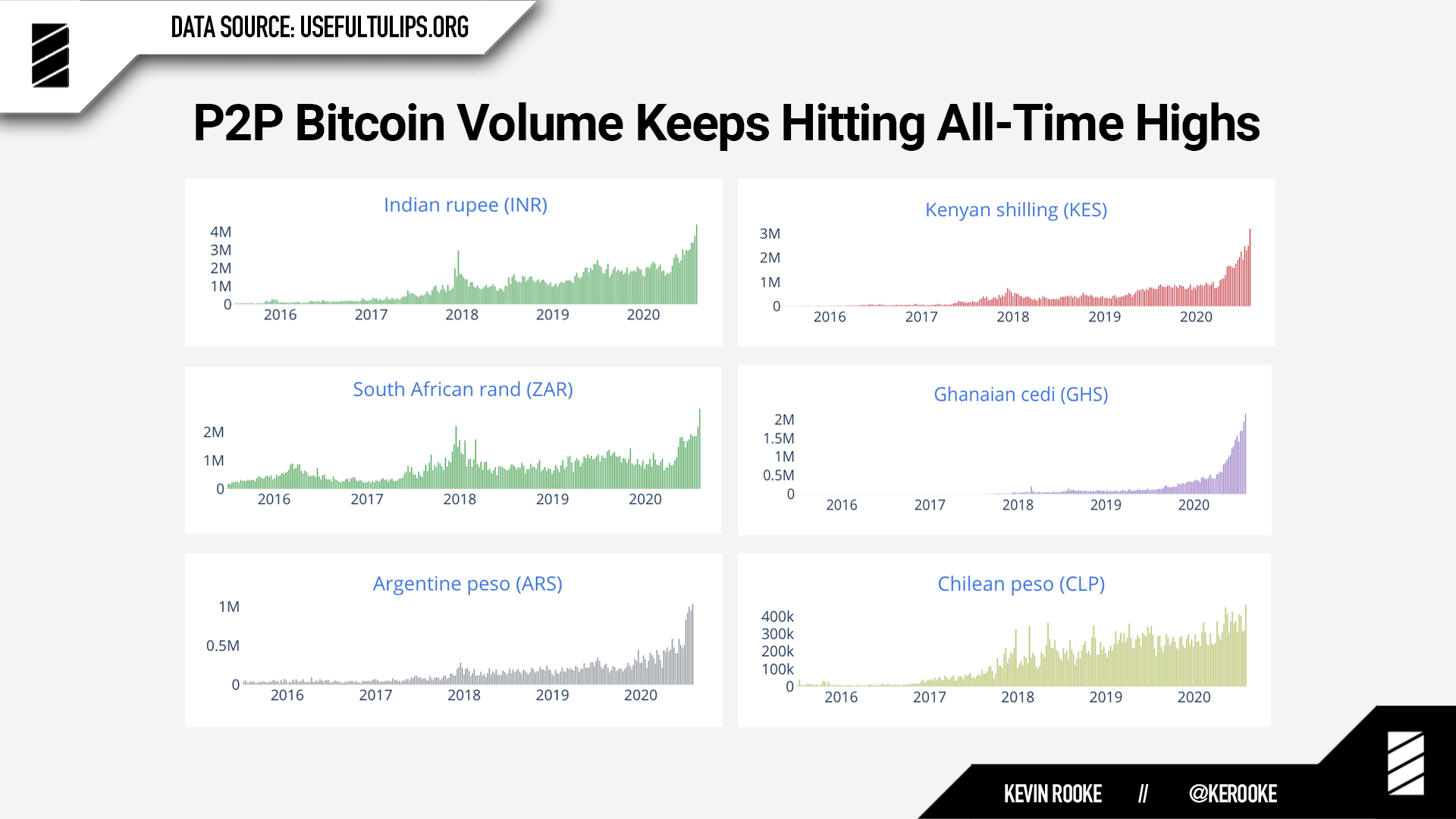

Overall, despite the increasing popularity of DEXs, peer-to-peer exchanges have considerable market share and are gaining popularity quickly.

In this guide, two of the presented exchanges require users to pass KYC (LocalBitcoins & Paxful), whereas the remaining don't.

Ultimately, this comes down to individual risk assessments and if one believes KYC to be a necessary evil or unnecessary. Regardless of identification requirements, all p2p exchanges introduced here make solid efforts to reduce fraud on their platform and facilitate trust even between counterparties that don't know each other.

If you consider peer-to-peer trading, which platform you go for will depend on your preferences and the cryptocurrencies and payment methods they support.

Another great additional method for cash to crypto transactions, or vice versa, is Bitcoin ATMs. Happy trading!