To understand how this is possible, it’s important to understand that throughout history, the hardest form of money has, and always will, win out in the end. Fiat currencies are nothing more than a financial experiment compared to other historical stores of value.

It may be hard for many to conceptualize this because we’ve only lived during the existence of fiat, but by zooming out from a historical perspective we discover fiat has only existed for a blip of time compared to the other respective forms of money that have existed.

Bitcoin's Superiority

Let’s now establish (in general simplified terms) what makes Bitcoin a superior form of money, particularly in comparison to gold and fiat currencies.

BTC is more divisible, verifiable, and transportable than gold. It is also the only form of money that can be audited at any time, by anyone, due to it being a protocol operating through the internet.

Arguably the most important aspect of Bitcoin and one of the main reasons it is such a revolutionary financial technology/ideology is the fact that it has a programmatic monetary policy that is not controlled by humans. Human control has always caused the erosion of currency’s value throughout history.

Even as far back as the Roman age, the government would clip silver off of coins, devaluing the currency, leading to social unrest and eventually the collapse of the Roman Empire.

It is vital to realize that all currency collapses have either rooted in human control of monetary policy, or a harder form of money coming along to replace it. Bitcoin is such a revolutionary invention partially because it is the first currency to completely eliminate the possibility of human manipulation of monetary policy/supply.

This is made possible due to two main reasons. The first being that node operators running the Bitcoin monetary network are decentralized across the entire globe, leaving no centralized point of control (or attack).

The second reason being that the protocol cannot be altered. New layers on top of the protocol can be created, but the base layer itself can not be changed and never has been since Bitcoin’s origins in 2009.

The supply function that is written into the protocol will never be changed, most importantly the supply cap. There will only ever be 21 million Bitcoins and there is no way to alter that. This makes Bitcoin superior to gold (and all other money) from a stock/flow standpoint.

As the value of gold rises, more miners step in with better technology and higher monetary incentive to create innovative ways to find new gold. Thus causing gold’s price to dilute back down every time there is a major rally, as more supply is generated. This is where the unchangeable supply function of Bitcoin differentiates itself.

When there is a major BTC price rally, new miners step in to get a piece of the action, but no matter how much stronger their mining technology becomes, they cannot be rewarded with more coins per each block they mine (blocks are mined roughly every 10 minutes) than what is programmed into the protocol (currently 6.25).

Every 4 years this block reward given to miners for confirming transactions on the network is cut in half. In 2009 the reward started off at 50 coins per block, in 2012 became 25, in 2016 became 12, and most recently in 2020 became 6.25 coins rewarded per block.

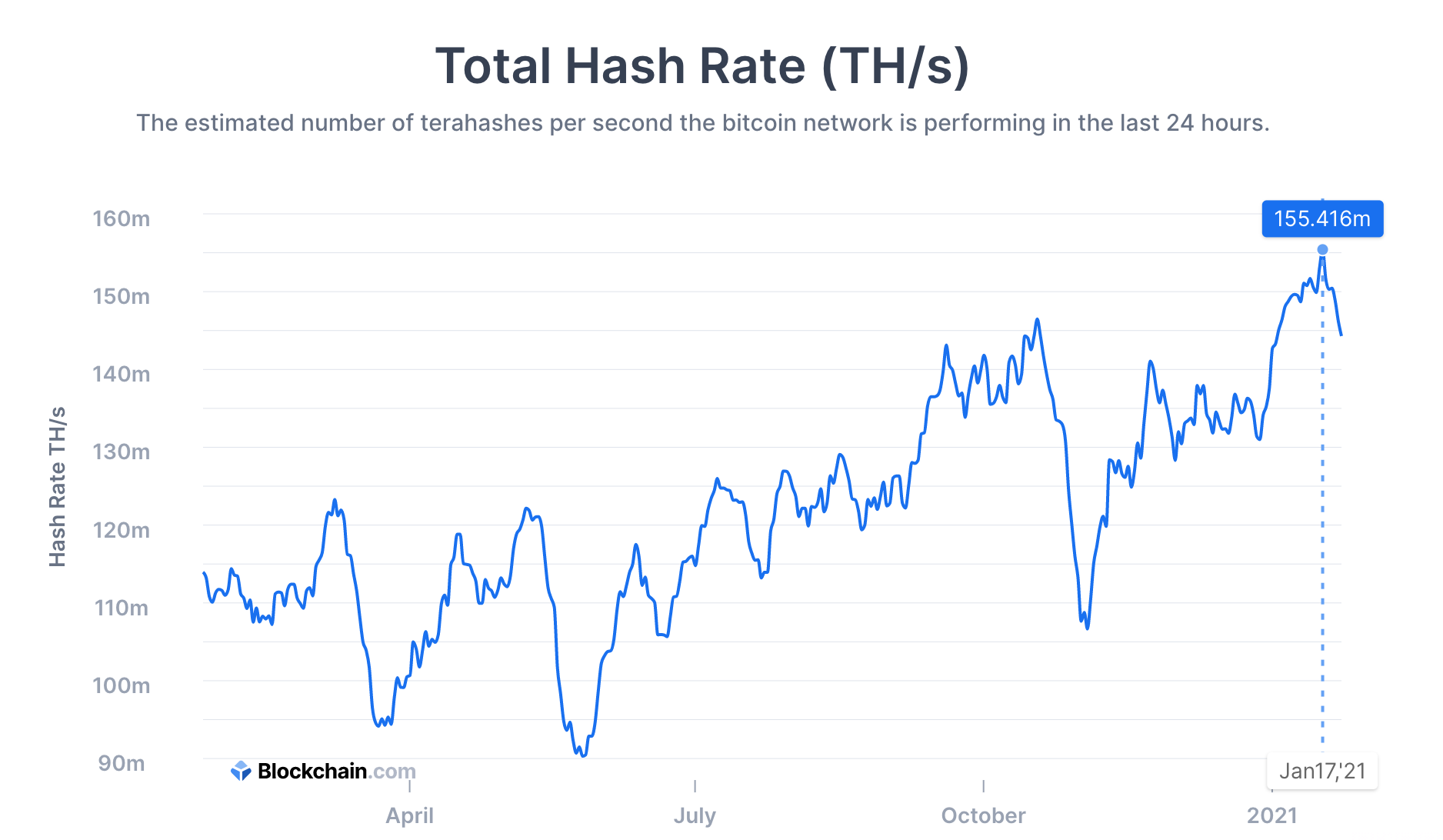

With this being said, if miners want a piece of a bigger piece of the action they have to each produce more hashrate. This creates a competitive acceleration of the hashrate protecting the network, thus making it more secure with each price rally.

Not only does it make the network more secure, but this programmatic supply function makes Bitcoin exponentially more scarce over time as the rate of flow diminishes. This feature of the protocol is vital to Bitcoin’s success not only from a price standpoint, but because it creates an effect of “Programmatic Entrenchment” into the traditional financial system.

Every four years after each respective halving, price rises because demand doesn’t even have to rise due to the rate of new supply cutting in half. Due to the basic supply/demand function, this causes the price of each coin to rise by default.

This price rise then draws in new participants (HODLers) into the network, in addition to more hashrate through miners as we previously discussed. During these exponential price rises, speculators step in towards the end, eventually leading to a blow off top.

Volatility as a feature

Many critics reference the fact that Bitcoin is volatile, but if you look at the history of money or any network for that matter, it is adopted in exponential waves of new adopters. In that aspect, the volatility is actually a feature rather than a bug. Traditionally there is a 75-80% decrease following each of these cycles, but after which there are more HODLers/miners left behind each time, raising the price floor before the following four-year cycle.

This idea was first noted by Saifedean Ammous in his book titled “The Bitcoin Standard”, but was visualized by a dutch quant investor going by the pseudonymous name Plan B.

He visualized these four year cycles by calculating price through scarcity and was able to do so due to Bitcoin’s programmatic absolute supply.

In the chart below you can see the four year cycles discussed, the blow off tops overrunning the stock-flow price function, and most importantly exponentially growing network effect when viewed on a logarithmic chart.

This network effect is no different than that of Facebook, but we have never seen such a thing measured in dollar terms before.

As stated, these four year halving cycles are crucial because they cause programmatic entrenchment into the financial system. Plan B has illustrated this using the term “phases”. The math behind these models will not be discussed in this article for simplicity purposes, but can be found on his website.

Escape Velocity

In theory, these network/price cycles will continue until finally breaking the stock to flow model to the upside, a concept Bitcoiners refer to as “Escape Velocity”. This would likely happen for two main reasons. The first would be that the US dollar hyperinflates, causing Bitcoin which is becoming exponentially scarcer, to be measured in a unit that is becoming exponentially LESS scarce.

The other way this could occur would be for enough market participants to discover the model, causing them to front run it. This would have a self-enforcing effect on the price, and when you get into the multi-trillion-dollar market cap range, people will begin to do due-diligence on Bitcoin, thus realizing it is a superior form of money. The more likely outcome is a combination of both phenomena.

This exponential “S-Curve” adoption is nothing that has not occurred before in society, its just that many have never seen this effect take place through something with a monetary value attached to it. “S-Curve” adoption can be visualized with the chart below:

For Bitcoin, this “S-Curve” adoption would theoretically look something like this:

There is no way to predict what Bitcoin will ultimately be priced in nominal dollar terms. This is because there is no telling how much more money will be printed leading into the future.

In 2020 alone the US Federal Reserve printed over 30% of the entire monetary supply, and the new 1.9 trillion-dollar stimulus bill that will likely pass, is larger than all of the money inserted into the system during 2020 combined.

Assuming Hyperbitcoinization were to occur, the only true equation to determine price measured in dollars is the following:

∞ (Dollars) / 21,000,000 (Bitcoins)

On this note, the only way to describe the value of a Bitcoin after the collapse of the dollar would be in terms of wealth distribution.

One way to illustrate the gravity of a monetary system divided by 21,000,000 is the fact that there are not enough single coins for each of the 46,800,000 millionaires in the world to each respectively own an entire Bitcoin. Post-Bitcoinization, even .25 of a coin would be considered an extraordinary amount of wealth.

This sounds great for everyone who currently owns Bitcoin, but why is it in the best interest for society as a whole to be measured under a scarce monetary supply?

First, let us think about this from an investor’s point of view. In a general sense, when trying to value a business, you are taking the track record of free cash flows and trying to predict these free cash flows into the future.

You then compare what you predict those future cash flows will be to the current valuation, and then can conclude if the business is worth investing in based off its current valuation. There is one problem. This process assumes that the “measuring stick” you are using, which is dollars, is constant.

This is most certainly not the case, therefore making the process of valuations based off free cash flows difficult. Another way to think of this idea would be to imagine building a house with a ruler was constantly changing, it would be near impossible.

Having a constant in place, like the speed of light in physics, opens a whole new rational way of approaching a respective subject.

By introducing a constant to the financial system, it would benefit investors enormously. Due to the unchangeable aspect of the base layer protocol and therefore the supply of coins, Bitcoin is that constant that is needed to fix this problem in the current financial system.

In addition, if businesses are not generating free cash flows, they are unable to stack Bitcoin’s on their balance sheet. Given the current zombie company bailouts taking place under the current system, this need to generate free cash flows would be a revolutionary move forward for capitalism and push towards a true free market.

A scarce monetary supply benefits not only investors but general members of society. For the first time in nearly 100 years, there is incentivization for saving again. Under the current system, one must invest their money into assets that appreciate against dollars, not just receive a return on their money, but simply preserve their wealth against inflation.

Most savings accounts today yield far less than the increasing rate of inflation in real terms. Under a Bitcoin system, you no longer must be searching for ways to put your money to work. Instead, people must generate a product, service, or asset that you deem to be worth letting go of some of your money.

This idea that one no longer needs to search for ways to deploy their cash just to beat inflation is a great step forward for many simply trying to preserve the value of their life’s work. Bitcoin was first adopted in countries with hyperinflating currencies overseas, as it was a superior way for citizens of those countries to protect their wealth.

These early adopters at the left side of the S curve will benefit most from this monetary system. Large governments will be later adopters of the system, therefore making BTC the greatest wealth transfer in the history of mankind.

Based on the United States’ current stance on Bitcoin, it looks like they may be one of the last.

Regulating Bitcoin

This brings up the concept of game theory. Many claim the United States government will surely shut down Bitcoin because they are used to the government being able to bully anyone they want. But as mentioned earlier, the decentralization and sheer size of the Bitcoin monetary network is, in my humble opinion, now past the point of return and is near impossible to shut down.

Any raised capital gains tax on Bitcoin gains incentivizes people not to sell their coins and HODL them longer, counterintuitively raising the price. Also, counter to what people have thought, states are beginning to show early adoption to Bitcoin to draw in users of the monetary network and increase their state’s respective economic output.

Any adopters of the monetary network are likely to leave states (or countries) with harsh Bitcoin regulations for places with the opposite.

In my opinion, the creator of Bitcoin had an immaculate understanding of game theory. It also needs to be understood that the United States is the only country that gains great benefit from itself being the reserve currency.

For example, this allows them to have greater control of trade, and gives them the power to inflate away their own debt. For other countries, however, especially those like China and Russia will jump at the opportunity to take that reserve currency status away from the United States.

This means that even if the United States doesn’t want to adopt Bitcoin, they will have no choice but to eventually take a partial position on their balance sheet to hedge against possibly losing power during a transition to a global Bitcoin monetary system.

In conclusion, any regulations against Bitcoin from the United States government are just delaying the inevitable, and they would be better off taking steps to embrace this new technology, in ways other countries have done such as Singapore.

In Conclusion

Hyperbitcoinization is not improbable, but inevitable.

This monetary revolution will usher in a new paradigm of self-sovereignty, government limitation, and economic empowerment.

Bitcoin will lead to a new renaissance of prosperity and innovation for all. Those who push Bitcoin ideology allows themselves to be scrutinized because they are adopting the network not just for their own financial gain, but because they understand the benefits the network will provide to the world, especially for groups that have never been given the opportunity to flourish.

I conclude this article by asking you to take the leap with me from a past filled with limitations to a future of unlimited possibility, made possible by the Bitcoin monetary network.

8 minute read

8 minute read