Our savings accounts can be thought of as the sum value of the energy output of our life’s work.

Inflation is a hidden tax on the common people and is something you need to understand and be positioned accordingly as both an investor/citizen moving into the near future. Imagine the value of your life’s work cutting in half every 15 hours, at no fault of your own, this is what happened during the worst case of hyperinflation ever in Hungary, 1946.

Given the unprecedented levels of money printed that have occurred in the United States since March of last year, why haven’t we experienced a dramatic rise in the prices of every-day goods/services around us? How is Bitcoin the solution to this problem? What factors could accelerate this process?

This article will answer these questions in vernacular that is easy to digest.

What is Hyperinflation?

In layman’s terms, inflation can be defined as a greater amount of money for the same number of goods/services.

However, hyperinflation can be defined as inflation occurring at a rate greater than 50% a month.

This means that by holding your wealth in a hyperinflating currency, the number of goods/services you are able to buy at the end of every month cuts in half. The only way to maintain purchasing power in this environment would be to own a scarce asset that is appreciating relative to that currency.

As history has shown, this phenomenon is crippling to a nation’s economy, as many participants are able to buy fewer goods/services thus shrinking economic output.

This shrinking in output causes businesses to cut back costs and ultimately a decrease in employment levels. A decrease in jobs leaves a surplus of demand for the available supply of jobs, meaning wages are bid down to the lowest taker and many are left out of work.

This is contrary to the current environment of growth we’ve become accustomed to, where growth funded by debt leads to increasingly more jobs. This increase leads to a surplus of jobs for the number of skilled laborers seeking them, thus causing wages to rise over time.

We have established how hyperinflation would be detrimental to you, but why haven’t we experienced it yet since March 2020 after historic levels of money supply expansion through Quantitative Easing/liquidity inserted into the fixed-income market?

To understand this, we must understand how we got to this point.

Monetary policy backdrop

Following the 2008 debt crisis that brought the global economy to the verge of a deflationary depression, liquidity was inserted into the system to offset the destruction of value caused by the crises.

Since then, this liquidity insertion, mainly taking place through Quantitative Easing, has been the main tool used to keep the economy afloat, along with the lowering of interest rates. By inserting liquidity through the bond-market, the Fed is able to artificially inflate asset prices and other nominally measured values, given the illusion of real growth. By lowering interest rates, the Fed essentially gives businesses a larger profit margin, which appears as economic growth, but in reality, is just the decrease of interest rates.

These two “tools” (Q/E, Interest rate lowering) have been used alongside each other to artificially stimulate economic growth.

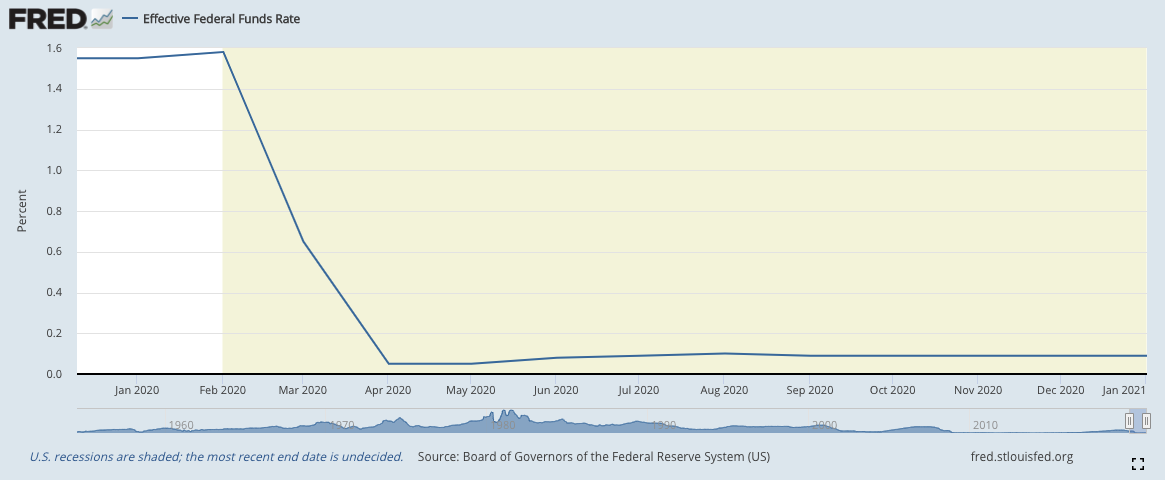

That was until after the March 2020 liquidity event that forced the Fed to lower rates drastically, coming close to 0%, thus leaving them no wiggle room to use interest rate lowering as an effective method of stimulation moving forward.

With businesses having to shut down due to the pandemic, revenues were unexpectedly dropped to historically low levels for many industries.

This loss of revenues made it nearly impossible for some businesses to pay off their debts, especially given how little savings many businesses are incentivized to have. Rather, these businesses are incentivized (via inflationary monetary policy) to continually reinvest revenues into further growth, instead of saving, which would lose spending power sitting idle.

This loss of revenues created a shortage of dollars and put pressure on the Fed to provide stimulus relief. In addition to this, countries around the world flocked to dollars/treasuries as a safe haven during this time of panic.

This massive demand for dollars needed to be offset by massive levels of stimulative liquidity insertion as well. With this massive demand for dollars and interest rates .25% from 0, the Fed had no choice but to insert historic amounts of liquidity into the system to offset this deflationary pressure.

In the chart below you can clearly see the uptick in the value of the US dollar in March, thus indicating strong deflation (see below). This is followed by a steady decrease in value up to today, as the Fed continues to insert more liquidity, inflating the dollar back to some extent of “equilibrium”.

This insertion of liquidity weakens the dollar’s value while increasing the value of assets measured in dollars.

How much liquidity did it take to cause inflationary forces to outweigh the deflationary?

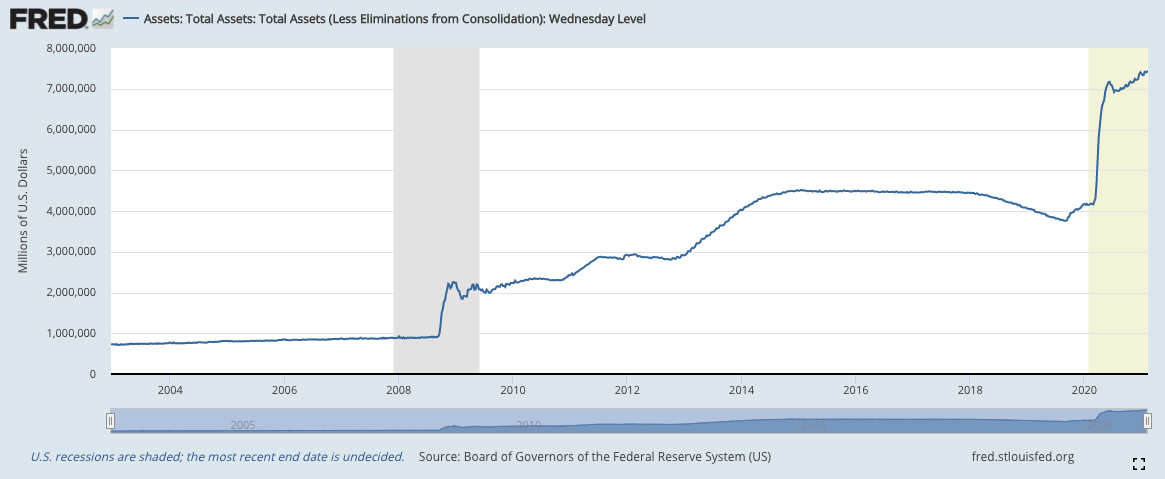

The answer is A LOT. Over the last 12 months alone the Federal Reserve’s balance sheet grew from 4 Trillion to 6.7 Trillion dollars or over 41% of the entire supply of dollars that have ever existed. The new 1.9 trillion dollars stimulus plan proposed is greater than all the money printing in 2020 combined. This can be visualized below:

This is the simple reason why we have seen all-time highs in the stock market since March and a massive rally in housing prices.

Liquidity insertion is the only rational explanation for the rallies seen recently in almost every asset, as they defied all logic for markets to have recovered so drastically during times of unprecedented debt levels and uncertainty for the economy.

During deflation, the value of the dollar increases, as the value of assets decreases. During inflation, the value of the dollar decreases, as the value of assets increases. The indescribable amounts of liquidity cause asset prices to rise by default, given the definition of inflation is more dollars for the same amount of goods.

This increase in asset prices is the main reason we have yet to see broader inflationary effects to traditional indexes such as CPI (Consumer Price Index).

Rather than trickling down into the broader economy, money is being stuffed into assets. This can be illustrated by the velocity of money.

The velocity of money is a measurement of how often money is changing hands. In the chart below you can clearly see as the expansion of the Fed’s balance sheet increases, the velocity of M2 Money Stock is accelerating downwards.

This phenomenon has massive societal implications. It means the wealth gap is increasing, as the newly created money is put in the hands of the wealthy and stuffed into assets, never trickling down.

At the same time, the average person with a savings account is getting their spending power diluted. This shows the paradox and hypocrisy of the Fed acting as if money printing benefits the people, but in fact, has the complete opposite effect.

Many of the social issues we have seen unfold in recent years can at least partially be accredited to decades of inflationary monetary policy causing greater wealth concentration.

However, eventually, the newly created money will likely move into the broader economy over time as wealthy people sell assets to purchase goods/services. After all, assets are ultimately bought not for the ownership of the asset itself, but for the hope of being able to buy more goods with the appreciation in the value of those assets.

In addition to the Q/E that is being stuffed into asset market capitalizations, we have seen some UBI (universal basic income) as well. This is the direct insertion of liquidity into the hands of the people.

However, we have likely not seen the effects of this either as the uncertainty of the pandemic has incentivized austerity, not to mention the limitation of goods/services to currently buy (no travel, no dining, movies, shopping, etc..)

Once the uncertainty from the pandemic passes, we are likely to see the full effects of the money supply expansion as people begin to buy more goods/services.

Now that we’ve established how high levels of inflation have a high likelihood of taking place, let’s take a look at the solution, Bitcoin.

Bitcoin's unique properties

Traditionally the scarce asset of choice investors flocks to during inflationary environments has been gold. That is until Bitcoin was founded in 2009, as a 10X improvement on the properties that make gold an attractive asset to hold.

Being a programmatic protocol existing through the internet, the amount of Bitcoin supply can be audited at any time, by anyone (18,600,200 at time of writing). This makes it absolutely-scarce. There will only ever be 21 million Bitcoins in existence, with the final coin being mined sometime around the year 2140.

Another key aspect of Bitcoin that differentiates it from any other asset is its 4-year halving cycles. For simplicity purposes, we can describe this as the rate of supply of new Bitcoins being created is cut in half every four years. When these halvings occur, demand can stay the same but price will go up by default.

This initial impulse is what gives each Bitcoin price run-up momentum. This occurred in 2012, 2016, and most recently in May 2020. The chart above illustrates the supply of bitcoin (blue line) against the rate of new supply of coins which diminishes over time (orange line).

This diminishing supply can be put into perspective by considering the following: there are 18.5 million coins after 12 years of existence, but the final coin will take nearly 40 years to be introduced into supply!

This means you are measuring something becoming exponentially scarcer (Bitcoin) in something that is becoming exponentially less scarce (USD).

3 factors accelerating Bitcoin’s Black Hole Effect

This effect is accelerated by several phenomena I think are worth understanding: Speculative-Attack on USD (made popular by Pierre Rochard), the thesis of a new Risk-Free Rate derived from Bitcoin, and the concept of lending Over-Collateralization that is an effect of seeking out this risk-free trade (both conceptualized/made popular by Preston Pysh).

Pierre Rochard’s “Speculative Attack”

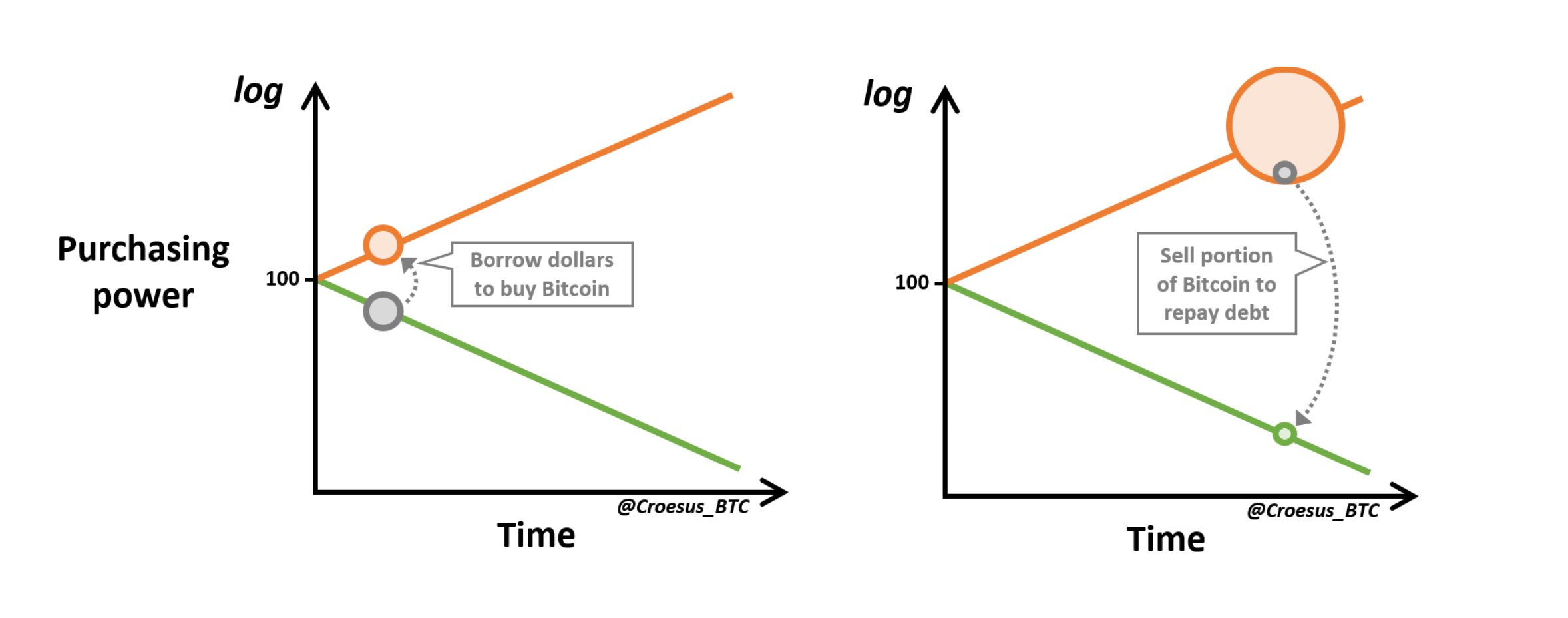

Speculative attack is the idea of leveraging the collapsing US dollar to acquire more Bitcoin early in the transition to this new system based on the Bitcoin monetary network. As Bitcoin appreciates in US Dollar value, it makes the dollar-denominated loan taken out to buy the coins easily payable.

This visual created by @Croseus_BTC illustrates this well:

This concept has already happened in the case of Michael Saylor’s Microstrategy. Finalized on December 12th, 2020, Microstrategy issued $650,000,000 of convertible debt notes at a .75% annual interest rate, using the capital to acquire more Bitcoin.

Saylor effectively leveraged the depreciating US dollar to stack more coins on his balance sheet which are appreciating. In my humble opinion, I see this as a genius move and one that others will likely copy in the coming months.

If the US Dollar really was to reach an uncontrollable level of inflation, a last move by the Fed may be to do this same trade on a Federal level by printing dollars to acquire Bitcoins to stack on their balance sheet. Only time will tell.

Preston Pysh’s Yield Spread/Over-Collateralization Thesis

Recently, Preston Pysh has said that he’s starting to think hyperbitcoinization might be less qualitative and more quantitative.

In remarks he made earlier in the year, he often suggested that the breakdown in fiat would occur from an erosion of trust. This trust didn’t have a numeric value which makes it difficult to determine when such an event could occur.

But based on his more recent comments, maybe it is becoming more quantitative. For example, during a recent show with Peter McCormick, he talked about institutional investors and retail investors alike being able to capture near-risk-free returns in the Bitcoin derivatives market.

Since Bitcoin is a very volatile asset, buying the underlying and selling longer-dated futures simultaneously provides substantial returns - especially when compared to any other financial market that’s traded with this much liquidity.

As an example of this, I’d like to reference a recent tweet from data analyst Willy Woo:

Unlike traditional debt markets, much of lending in the crypto economy is done with over-collateralization.

For example, if a person wanted to borrow 1 BTC today, they might need to deposit 2 BTC worth of value while also paying a 9.75% annual interest rate. This over-collateralization process is in effect causing more and more Bitcoin to be locked into escrow, while also protecting the BTC lenders from default because the BTC markets trade 24 hours a day and 365 days a year.

Now, it’s important to highlight that not all lending/borrowing platforms are requiring over-collateralization today (particularly for institutional borrowers), but many suspect as prices become even more volatile moving forward, depositors will demand such over-collateralization to protect their funds.

Unlike the traditional fractional reserve system that most market participants are accustomed to, the crypto-economy is dramatically different. This shift to over-collateralize is how risk is reduced between borrowers and lenders.

So, if a person has a meaningful amount of Bitcoin, they can now borrow against that Bitcoin to conduct the risk-free trades described above in the futures market to keep adding additional yield to their portfolio.

This appears to be providing an incentive structure to make Bitcoin even more scarce and sought after as “perfect” collateral with no counterparty risk and near-immediate liquidity. In fact, this can actually be seen by current lending rates.

Today, if a person were to deposit USDC into a lending platform, the interest being paid is double that of Bitcoin. This is a crazy thought for people in the traditional finance world that view the “risks” of Bitcoin to be indescribably higher than fiat currencies.

But here it is, on every lending platform around the world, and in the free and open Crypto market: lending rates for fiat (9.6%) are higher than Bitcoin (4.5%).

An additional consideration when thinking about the implications of this long-short near-risk-free investment strategy is that it becomes more lucrative as volatility and prices become more dramatic.

This means more and more Bitcoin will be locked into escrow as the trade becomes more popular. Not only are traders implementing this strategy locking up the bitcoins until the duration of the contract is complete (for European style contracts), but for physically settled exchanges, the escrow to write the contract is 100% collateralized on many exchanges.

So, if the spreads provide greater returns for longer duration contracts, those Bitcoin are locked-up for even longer terms. Now, if this dynamic were true we should see the open interest for such derivatives grow over time - and here’s the chart.

Given that coins are already being removed from the available supply (off exchanges) at a record pace, this concept described by Preston Pysh will just accelerate the supply suffocation already occurring. The chart below illustrates the rate at which coins are already being withdrawn from exchanges, therefore not available to be bought:

Bitcoin’s "Black Hole Effect" on asset prices

Another important point that Pysh discussed during the What Bitcoin Did Podcast was this idea that lending rates will go higher.

He suggested that as the price and volatility grows in magnitude, it could drive an influx of borrowing interest while also reducing Bitcoin deposits, thus driving the free and open interest rates in these markets higher.

In fact, it could potentially set-off a “light-bulb” moment for traditional fixed income investors as they view the disparity between NIRP lending rates and double-digit free and open crypto rates.

This concern only becomes more likely as Bitcoin breaches a trillion in market cap and is taken more seriously by global banks, payment processors, and institutions alike. If such a scenario would play out, one can’t help imagining the result it could have on discount rates/capitalization rates for equities. Especially in a world where everyone seems to believe inflation doesn’t exist and rates continue to go negative.

Pysh used an example on the show where he suggested that if the market started to agree with USDC lending rates at 10%, that means equity PE ratios would need to be priced at 10 or lower to attract Bitcoiners out of their position and into stocks.

As we know, current market premiums are priced at 30 to 35 times earnings today, so if such a scenario were to occur, it would reprice stocks at 2/3rds the price of today in Bitcoin terms. Finally, let’s not forget about the 120 trillion dollar traditional fixed income market, what would it mean for that?

Well, if the entire market is denominated in an eroding currency that the rest of the business world stops using to conduct economic calculation, I suspect it results in intense impairment for the owners of such financial instruments.

11 minute read

11 minute read