Markets are evolving multi-dimensional entities where moves made by large enough participants have potentially decision-altering consequences for the rest of the market.

Game theory can be defined as a theoretical framework for conceiving social situations among competing players. One who understands game theory considers not just the direct implications of their initial action, but the potential outcomes of those implications as well.

The common phrase “think one step ahead” is a bi-product of thinking using game theory.

This article will discuss in laymen’s terms how surface-level game theory is embedded into Bitcoin on several levels (Corporate, State, Federal) and recent moves that are likely symbolic first dominoes falling in this dynamic of Bitcoin market game theory.

Game Theory in Fiat Currencies

It is first worth mentioning that the game theory embedded into the current fiat system is both unhealthy and unsustainable.

Currently, countries are incentivized to competitively devalue their currencies to make their exports more attractive. Since March of 2020, this effect has only been amplified.

There is a close correlation between a nation’s currency and how much its workers are paid. Any nation that devalues its currency also lowers its cost of labor in comparison to other global competitors.

This process can generate some growth in the short term because the respective nation’s goods cost less to buyers than other countries. Through this process, countries trying to compete for the same scarce jobs devalue their currency.

This competitive devaluation inadvertently pushes up all asset prices being measured in those currencies in the process.

Another way the United States specifically is incentivized to devalue their currency, thus forcing others to follow, is because of how easily they can print themselves out of debt.

If the US borrows $100 at a 10% interest rate, they owe back $110. However, they can simply print 10% more money, thus debasing the currency by that factor.

When they finally pay off the loan, they are paying back that nominal $110, but it is worth considerably less in spending power.

Printing of money has also incentivized corporate banks to act recklessly in the recent decade, as these banks know that the Fed can simply step in and print money to bail them out.

The incentive structure built around the current fiat system is not healthy or sustainable and is ultimately hurting the average citizen with a savings account more than anyone.

Game Theory in Corporations

From 2017-2019 a slew of small investment funds such as Galaxy Digital have taken on Bitcoin.

However, 2020 would be the first time a publicly-traded company began to allocate a substantial portion of its balance sheet to Bitcoin.

On August 11th, 2020 MicroStrategy announced that they had purchased 21,454 Bitcoins at an aggregate purchase price of $250 million. On September 14, 2020, MicroStrategy completed another acquisition of 16,796 additional bitcoins at an aggregate purchase price of $175 million.

Not only did they allocate their treasury to a Bitcoin standard, but have issued several rounds of convertible debt notes as well. Each of these raises was oversubscribed, with the most recent offering raising $900 Million in the capital at a 0% interest rate.

This concept popularized by Pierre Rochard years ago titled the "Speculative Attack on the Dollar” will likely seem more attractive to other corporations in the future as it becomes clear Bitcoin will emerge as the dominant global currency.

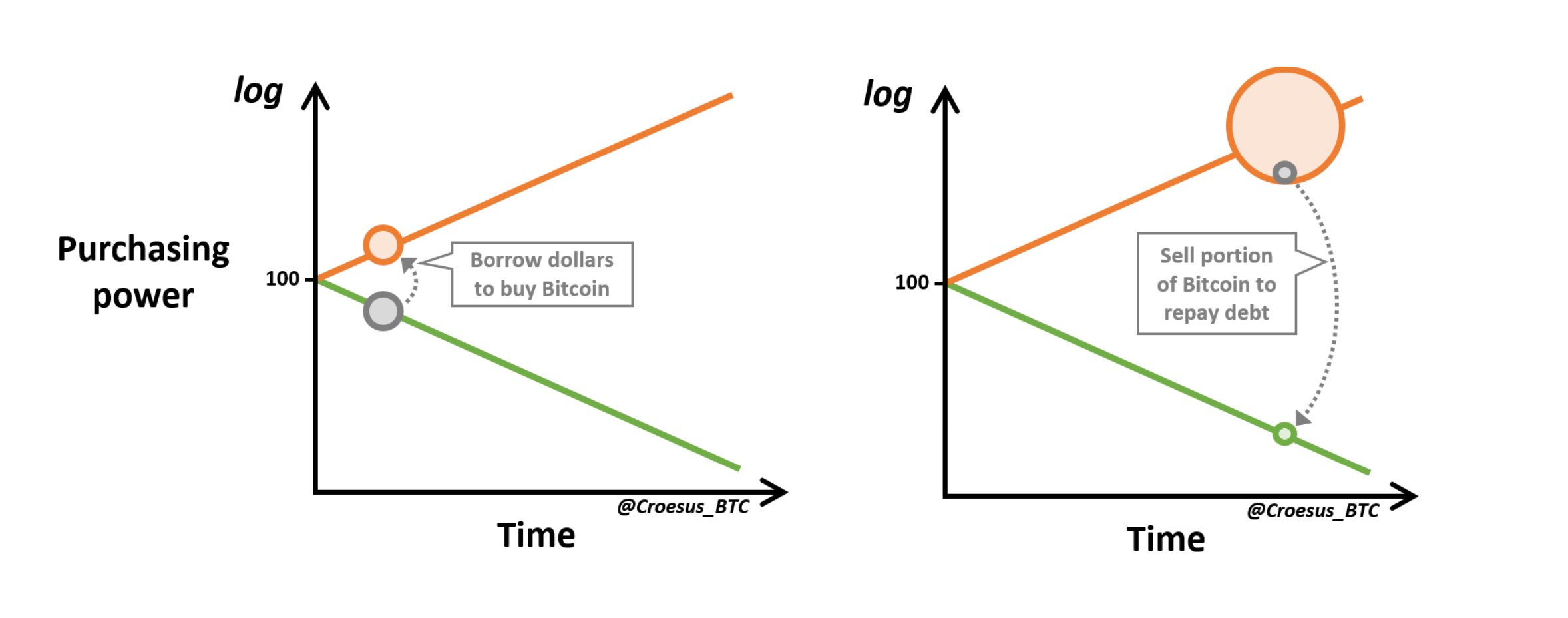

Essentially what MicroStrategy is doing is leveraging a failing currency to acquire the hardest form of money in the history of mankind.

This process can be visualized by a graphic created by (@Croseus_BTC)

The company paved the way for future corporations such as Tesla to acquire Bitcoins not only in terms of public acceptance but because they already had created a playbook for Tesla to simply copy.

In this sense, MicroStrategy was a pioneer amongst other public companies, as they set the precursor for how to buy Bitcoins without significantly moving the price.

CEO Michael Saylor describes this process on a podcast saying, “I bought $1,000 worth of Bitcoin every second in the evenings and the weekends, I bought $2,000 worth of Bitcoin during the day.”

The company also paved the way regarding accounting, tax, and regulatory standpoints. On February 5th, MicroStrategy hosted a conference titled, “Bitcoin for Corporations” where they laid out their thesis and strategy for acquiring BTC.

This information is publicly available as well as their downloadable “Bitcoin Corporate Playbook”.

After MicroStrategy, Mass Mutual acquired $100 Million in Bitcoin. In addition, the most well-known recent acquisition was Tesla acquiring $1.5 Billion of Bitcoin, 10% of their cash reserves, with also plan to accept Bitcoin as a form of payment for their cars.

Square recently released their earning statement revealing a purchase of 3,318 Bitcoins at an aggregate purchase price of $170 Million.

With MicroStrategy arguably being the first domino to fall, the dam has been broken and corporations are beginning to seriously consider allocating some of their treasuries to this protocol. With the major players mentioned above taking stances on Bitcoin and the dramatic positive effect it has had for shareholders, CFO’s are taking a serious look at getting BTC on their respective balance sheets.

The game theory behind this within corporate CFO’s is likely why there has been such a dramatic upswing of liquidity moving into Bitcoin, most recently reaching a $1 Trillion market cap.

It is important to mention that it takes months for many large corporations to approve a move like this, with many hurdles and hoops to jump through. One of the main reasons MicroStrategy was able to complete the acquisition in such a timely manner was because Michael Saylor has the majority of voting rights.

With this being said, not only are companies looking to be early adopters which would translate to spending power appreciation but also because it is impossible to know just how many other corporate treasuries that are yet to come later in Q3/Q4 of this year.

In this sense, it makes sense to take at least a small allocation simply as a hedge against the success of the Bitcoin Monetary Network. If enough companies think this way, there could be unseen amounts of new waves of capital coming into the Bitcoin monetary network from corporate balance sheets.

Finally, it is worth mentioning this simple concept: MicroStrategy has acquired 90,531 BTC for $2,171,000,000 at an average price of $23,985 per coin. Tesla acquired 48,000 BTC for $1,500,000,000 at an average price of $31,250 per coin. If Tesla wants to match MicroStrategy, to acquire an additional 42,531 Bitcoins they must allocate an additional $2,126,000,000 (at the current market price of $50,000) of their balance sheet.

If a Bitcoin standard comes into fruition, whoever has the most coins will have the most spending power; let the competitive corporate stacking begin.

Game Theory in the United States

Here in the United States, with over 331 million residents, there is a unique dynamic amongst the 50 states of the country. Essentially, each respective state is competing against the other to draw in a portion of the total tax revenue.

The number of users on the Bitcoin Monetary Network has exploded in the US in recent years, with each of those users being a potential addition to tax revenues for all states. If the state of which a user of the network with significant skin in the game takes an “anti-Bitcoin” regulatory stance, it would make sense to just move to another state that has a friendly regulatory stance towards the network.

There have already been several first movers looking to step out ahead on the adoption curve, with the most well-known being Wyoming.

With these first-movers out ahead, other states must take a serious look at this; not adopting could potentially leave them behind, or worse, lose their tax revenue. If enough states that currently don’t have BTC-friendly regulations think this way, they will begin to take Bitcoin-friendly stances due to game theory.

Game Theory on the Federal Level

One way game theory is taking place on the federal level is in terms of adopting Bitcoin as a treasury reserve asset.

Early on, it will likely be smaller nation-states that adopt, particularly those that have centralized autocratic governments (have limited “hoops” to jump through). Large bureaucratic democracies such as the United States will likely be later on the adoption curve in terms of putting Bitcoin on their balance sheet.

This gives smaller nation-states an incentive and opportunity to front-run the larger countries, which would potentially gain them a massive amount of power through the process of hyperbitcoinization.

Also, similarly to states, countries themselves are also competing to draw in tax revenue and economic growth within their respective borders. If one country takes an anti-Bitcoin regulatory stance, they could potentially be losing a portion of their population to a nation that has a friendly regulatory stance.

I would suspect this effect to amplify with the adoption of the Bitcoin Monetary Network around the world.

We have already seen several nations (Malta, Singapore..) turn themselves into Bitcoin “safe havens” of sorts, as embracing this technology early on could give them an advantage over others and make their countries more attractive. If enough countries think this way, it could become a self-fulfilling prophecy.

To conclude, game theory is embedded into Bitcoin on several levels, each of which penetrates the traditional system as Bitcoin’s price rises and more users adopt the monetary network.

To end the article I’d like to leave you with a classic quote from Satoshi Nakamoto, showing the grasp on game theory they must have had:

“It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self-fulfilling prophecy.”

6 minute read

6 minute read