In the very beginning, there was Bitcoin.

Ever since the launch of Bitcoin in 2009, it was only a matter of time when the first attempts at copying it would occur. Due to it's open source nature, it is relatively easy to copy the source code and make changes to it.

But do alternatives that are easy to produce, without the favorable starting conditions that Bitcoin had, inferior in quality and legitimacy?

The answer, depending on who you ask, has been plaguing or empowering the cryptocurrency space for the past decade.

So, what is Bitcoin Maximalism?

The term "Bitcoin Maximalism" was coined by ex-Bitcoiner and co-founder of Ethereum, Vitalik Buterin, as a derogatory term to refer to the rejectionist attitude of bitcoin users towards alternative currencies.

Soon after, the term was hijacked by the very users who were targeted by it since they found it very fitting for the views they held.

This negative connotation suddenly turned into positive as bitcoiners saw a sense of qualified distinction behind being labelled with this term, both in terms of being purely a "bitcoiner" and rejectionist towards other blockchain-like systems or direct copies of Bitcoin.

Origins of the ideology

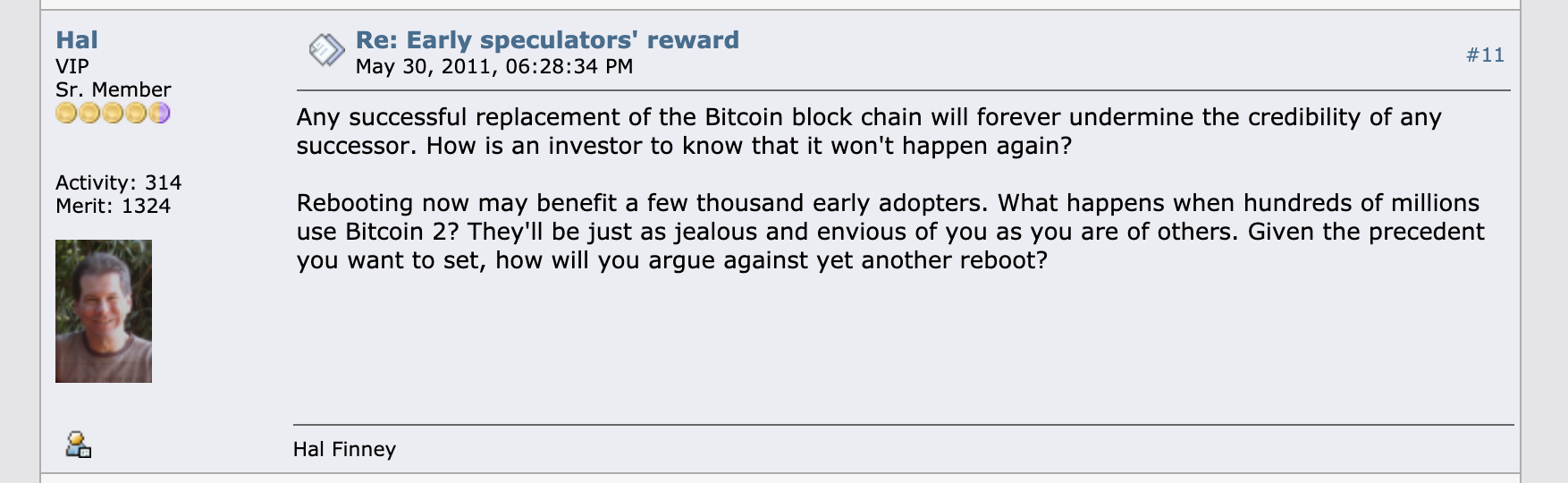

It was early bitcoin developer Hal Finney's reasoning back in 2011 that any alternative currency that would be capable of replacing bitcoin as the dominant monetary system, would shake the system's legitimacy.

This is because other competing ideas could also replace those that can replace Bitcoin. Therefore his conclusion was that they would become illegitimate to claim any position (due to inferior properties) and since such an event would shake everyone's trust, placing investments and further trust into them would prove less likely in the future.

Hal's comments are among some of the earliest notable mentions of the soon-to-be "Maximalist" movement that would polarize the cryptocurrency space.

How was the term "maximalist" adopted?

Bitcoiners from early 2011 to 2014 had no coined term for their Bitcoin-only ideology. When Vitalik used "maximalist" as a derogatory term against Bitcoiners, it ended up being the perfect term to fill the void that existed for the concept for many years.

As some would say, Bitcoiners turned the term against its maker because it was made with ill intent, and ever since then it has been a de-facto term for claiming personal value based superiority.

The term itself might be in a negative connotation but the way it managed to fit in among bitcoiners is now considered a good description when it is used for one individual.

Of course, those that support alternative cryptocurrencies say that “maxis” are somewhat toxic because they claim to think too highly of themselves with it.

Bitcoin's immaculate conception

Bitcoin's whitepaper was released in October 2008 to a cryptography mailing list by a pseudonymous cypherpunk named Satoshi Nakamoto. The whitepaper explained a purposed solution to the double spend problem.

2 months later, on the 3rd of January, 2009, Bitcoin was launched by Satoshi mining the first genesis block. This kickoff of the network was completely unique because the only other people who were interested in the idea of a completely sovereign digital currency at the time were the cypherpunks.

The code to mine bitcoin was available for everyone on the day Satoshi began mining and Satoshi definitely wasn’t mining alone. In a now legendary tweet (and the first historical mention of Bitcoin on twitter) Hal Finney announced that he was "Running bitcoin", mining days after the initial launch.

Embedded in Bitcoin’s first genesis block was a message set as a testament to the past explicitly warning against the overreaching power of national central banks.

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

The 2008 financial crisis likely played a big role in motivating Satoshi to solve the problem of taking money out of the hands of the government and putting it back into the hands of the people.

Satoshi received no funding for the start of Bitcoin and is rumored to have mined over 700,000 bitcoin that are still lying dormant, unspent on the Bitcoin blockchain ever since his disappearance.

Bitcoin’s value was $0 for nearly a year and a half after its launch. Miners were spending money on hardware and electricity to mine bitcoins, with no guarantee that the coins they received would ever have value.

The system Satoshi created was left to be slowly and organically adopted by curious users, who lost a lot of bitcoins on broken hard drives and other boating accidents along the way.

"Bitcoin benefited from a very rare set of circumstances. Because it launched in a world where digital cash had no established value, they circulated freely. That can’t be recaptured today since everyone expects coins to have value. The immaculate conception" - Nic Carter

Eventually speculators started arriving and it began gaining serious ground with its adoption and speculative capital.

Are altcoins bad?

Bitcoin’s open-source design has allowed the proliferation of alternative currencies that now millions speculate upon to find the “next big thing” that never comes to fruition.

The idea among others that “Bitcoin is the Myspace of cryptocurrencies” due to criticisms of it being not fast enough, innovative enough, evolving enough, is a fallacy.

Mark Zuckerberg has described Facebook’s motto as ‘Move Fast and Break things,’ capturing the spirit of rapid innovation that has prevailed across tech. Many projects in the crypto space have adopted a similar mentality not understanding that Zuck's motto is a philosophy you can't apply to a global reserve currency.

While copycat blockchains are praised for constantly pushing the envelope with new developments, Bitcoin moves slower.

Bitcoin’s deliberate updates process and calculated pace is a feature, not a bug.

To date, no project has ever gained as much traction or adoption as Bitcoin has. The value of a network is directly proportional to the square number of nodes connected to this network.

Each additional node increases the number of potential connections exponentially, making the network more valuable.

This theory, first devised by Ethernet Co-Founder Robert Metcalfe, highlights the fact no other network comes close to the size and diversity of Bitcoin’s ecosystem.

Bitcoin’s first-mover advantage has created a bandwagon effect that has drawn in a wealth of investors, developers, large companies, and nation states.

What about Ethereum?

Bitcoin has never been hacked in its almost 13 year history. In an industry that has suffered several setbacks at the hand of malicious actors, Bitcoin’s record remains unblemished.

Not all blockchains have been so fortunate. In July 2016, Ethereum infamously experienced an attack that drained 3.6 million ETH, the equivalent of $70 million at the time, from the DAO smart contract.

The fallout of the hack caused a split in the Ethereum network, hard-forking into two coins: Ethereum and Ethereum Classic, with Ethereum Classic choosing to maintain the original un-hacked blockchain.

This serves as a cautionary tale as to the consequences of insecure innovation.

Furthermore, not only has Bitcoin never been hacked, it has never suffered any downtime since 2013. In total, Bitcoin has been functional for 99.98% of its life, producing block after block with dependable consistency.

Can something beat bitcoin?

Game-theoretically, people will only abandon the largest network if they're quite sure that the majority of the network will leave with them, creating yet another incentive to stay home in Bitcoin.

If another 'relatively stable cryptocurrency with low inflation' comes around, it'll have to convince a majority of stakeholders (miners, Wall Street firms, Latin American governments, developers, node operators, ETF issuers, the SEC, etc) to abandon Bitcoin in favour of this new coin.

Since the Bitcoin ecosystem has developed, many big companies now exist that also have a vested interest in the continued development and maintenance of the Bitcoin Network. This interest in the ecosystem provides funding for developers to continue their work on the software and to find better solutions that can be incorporated into Bitcoin.

The users themselves also have shared interest in defending the network against certain forms of attacks that prevent other networks from gaining enough network effect.

Since Bitcoin has an existing and powerful social defensive layer, its users organize in order to protect it. This layer not only provides defense against confiscation, but also against arbitrary changes to the network that could compromise its uninterrupted function.

Users actively organize on social networks and actively spread the word about Bitcoin daily, completely for free, while other competing coins have been known to spend millions or billions of dollars on marketing in order to attract even the smallest amount of users.

Can Bitcoin Maximalism be toxic?

Bitcoin's social defensive layer can be attributed to what some might call a "naturally occurring toxicity".

The constant encroachment made by alternative coins that think they can compete with Bitcoin forces these individuals to act defensively and educate newcomers in order to prevent them from encountering not just a grave financial loss, but the loss of their participation.

When an oblivious newcomer enters the space and buys an alternative competing “shitcoin”, they don’t realize that they are not participating in any revolution, they aren’t saving purchasing power, and they aren’t really in it for technology, other than being in it for the thrilling experience of a digital casino to get rich quick.

Some might find that sentiment extremely toxic or discouraging, but others see it as ultimate means of liberating society from the shackles of central banking and monetary nationalism.

If you aren't willing to protect your property that every government will be against, then it will lose value and nobody will be willing to find value within it.

Although it is very difficult to measure whether or not this toxicity is a negative effect on bitcoin in any way, the increase in value and the amount of capital invested in Bitcoin shows that it could likely be on the contrary.

As long as there are users willing to defend Bitcoin, there will be toxic bitcoiners, and Bitcoin will have an inherent value provided to it by its users.

In conclusion, Bitcoin without you would fail and would never be able to become a monetary system that liberates the individual and restores sound economic principles into our big broken world.

5 minute read

5 minute read