There is nothing certain except death and Bitcoin taxes, or so the saying goes.

Do you have to pay taxes on Bitcoin? The sad answer you probably don't want to hear is yes.

How Bitcoin is taxed and how much you have to pay is entirely dependent on where you live. Countries worldwide treat cryptocurrencies differently.

In the US, for example, they are treated similar to property, and traders are taxed on capital gains. In Japan, however, cryptocurrencies are classed as a legal payment method and fall under income and capital gains tax. In France, digital assets are seen as movable property and taxed at a flat rate of 19%.

While many assume that it's only taxable when one turns crypto into fiat, every time you trade crypto for crypto or spend it on something is a taxable event that has to be reported.

What doesn't fall under taxable events is buying, HODLing, or transferring cryptocurrencies between different wallets.

To calculate the capital gains or losses, one needs:

Fair market value - the value one could sell an asset for on the market.

Cost basis - the cost at which an asset was acquired.

Tracking these every time you buy and sell can quickly become a convoluted and complicated process. Fortunately, various platforms on the market help traders track their trading and file their taxes in one fell swoop.

When choosing one software over another, a few important things to look out for are the exchanges, wallets, and services supported. Secondly, the countries the platform can generate tax reports for, ease of use, and pricing.

This guide introduces 4 popular and different crypto tax software that are all great options for active traders, businesses, or beginners to track and report their gains accurately.

Koinly

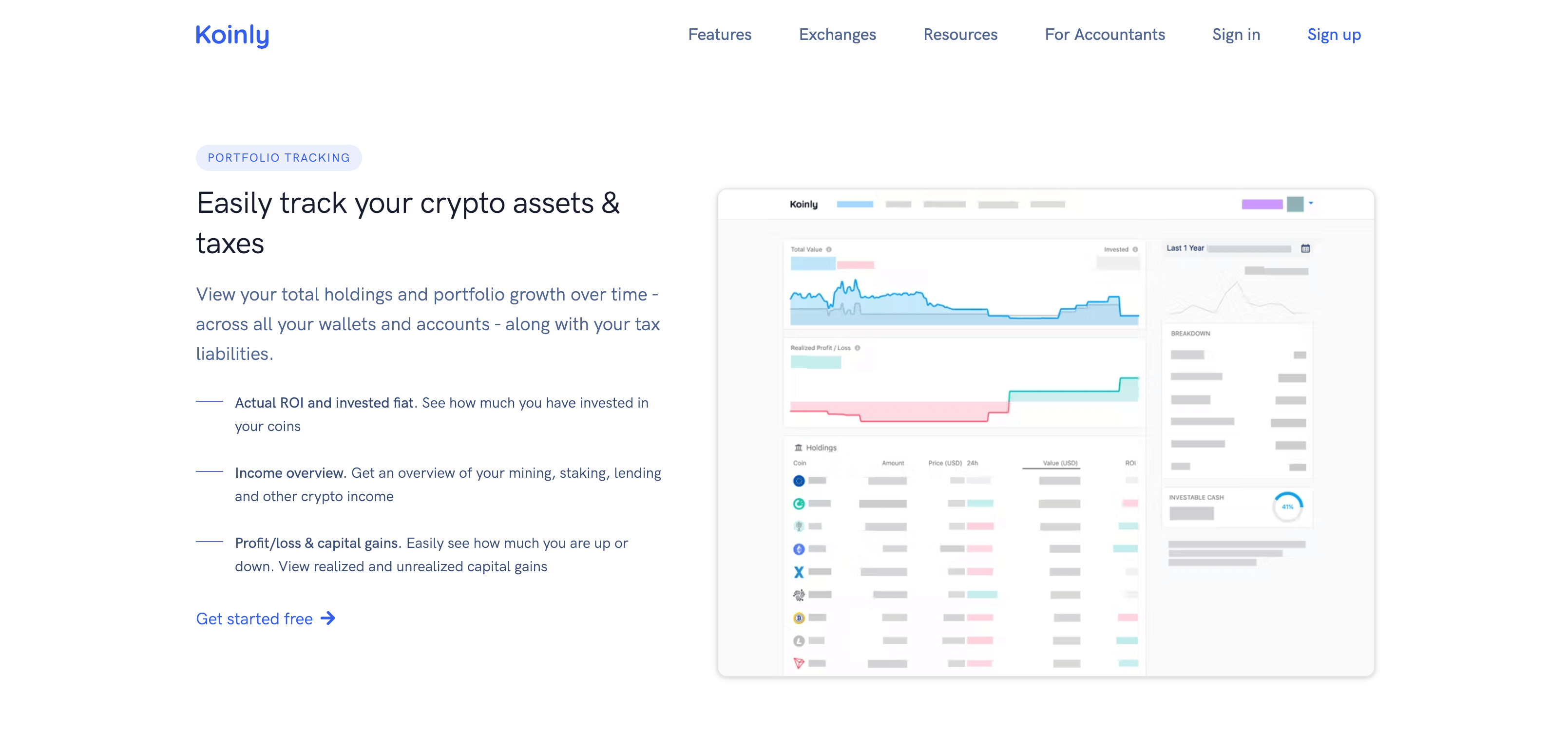

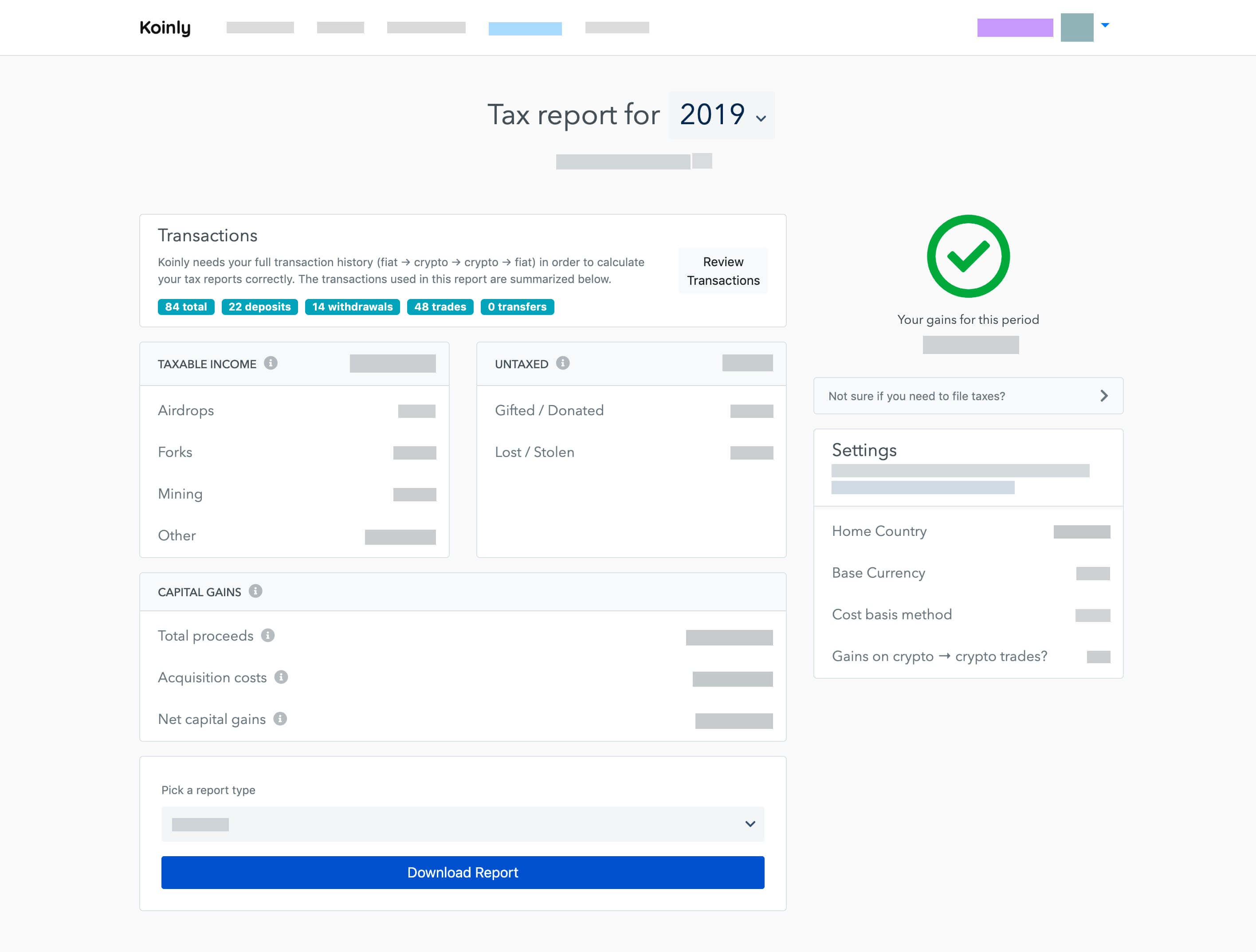

Koinly is a US company that was launched in 2018 and has since helped thousands of customers file their tax crypto reports. Koinly aims to solve the problem of crypto tracking and tax reporting by combining simple software with guidance.

The software includes simple views to see actual ROI (Return on investment), invested fiat (cost basis), an income overview from all activities such as staking, lending, PnL, and capital gains calculation.

The platform allows you to import data for 350 exchanges, 50 wallets, across 50 blockchains, and from third-party services like BlockFi and Purse. Koinly supports Bitcoin as well as over 1700 cryptocurrencies.

Koinly features a smart transfer matching to detect transfers within your wallets to exclude them from tax reports. It also supports various accounting methods, including FIFO, LIFO, shared pool method, and average cost.

Supported countries include the US, UK, Canada, Australia, Netherlands, Germany, Japan, Singapore, and 20 more.

For anyone looking to try the service, Koinly offers a free plan that provides users with the ability to track and view up to 10,000 transactions for free. They only have to pay when generating a specific tax report, making Koinly an excellent platform to track one's portfolio.

The Newbie plan covers 100 transactions for $49; Holders can track up to 1000 transactions a year and download tax reports for $99 per year. For more active traders, Koinly offers a trader plan that covers up to 3000 transactions for $179 annually or more than 10,000 for $279.

Overall, Koinly is an excellent option for anyone looking to track their portfolio for free and generate tax reports in more than 20 countries. The only potential downside is that they currently don't have a mobile app.

CoinTracking

![]()

CoinTracking is by far the longest-running platform in this post. This tax service software went live in 2013 as the world's first cryptocurrency tax reporting tool and portfolio tracker.

Nowadays, CoinTracking services more than 1 million active users, 2500 CPAs, and numerous corporate clients, with reliable trade analytics tools, real-time reports, and tax reporting. It enjoys an excellent reputation and is recommended to use by companies like Coinbase.

CoinTracking provides portfolio tracking and tax reporting features in one, generating a vast amount of insights such as balance by exchange, trading fees paid, average purchase prices, and trade tax-privileged coins (short and long positions).

Using Cointracking, one can track over 7000 cryptocurrencies and directly auto-sync accounts on more than 70 exchanges. If an exchange or wallet isn't supported, users can still opt in to import trades using CSV files.

![]()

With the free plan, users can generate tax reports although they are limited to 200 transactions, and tax and capital gains reporting up to 100 entries.

To gain more features, traders can opt into the Pro plan, which costs $166 per year (discounts available for longer terms) and supports 3500 transactions and unlimited manual import. With the Expert Plan, one can pick between 20,000, 50,000, and 100,000 transactions ranging from $203 to $329.

With its long-standing track record, high focus on security, and the ability to generate tax reports for over 100 countries, Cointracking is a safe and well-known choice for anyone looking to report their taxes.

CryptoTrader.tax (CoinLedger)

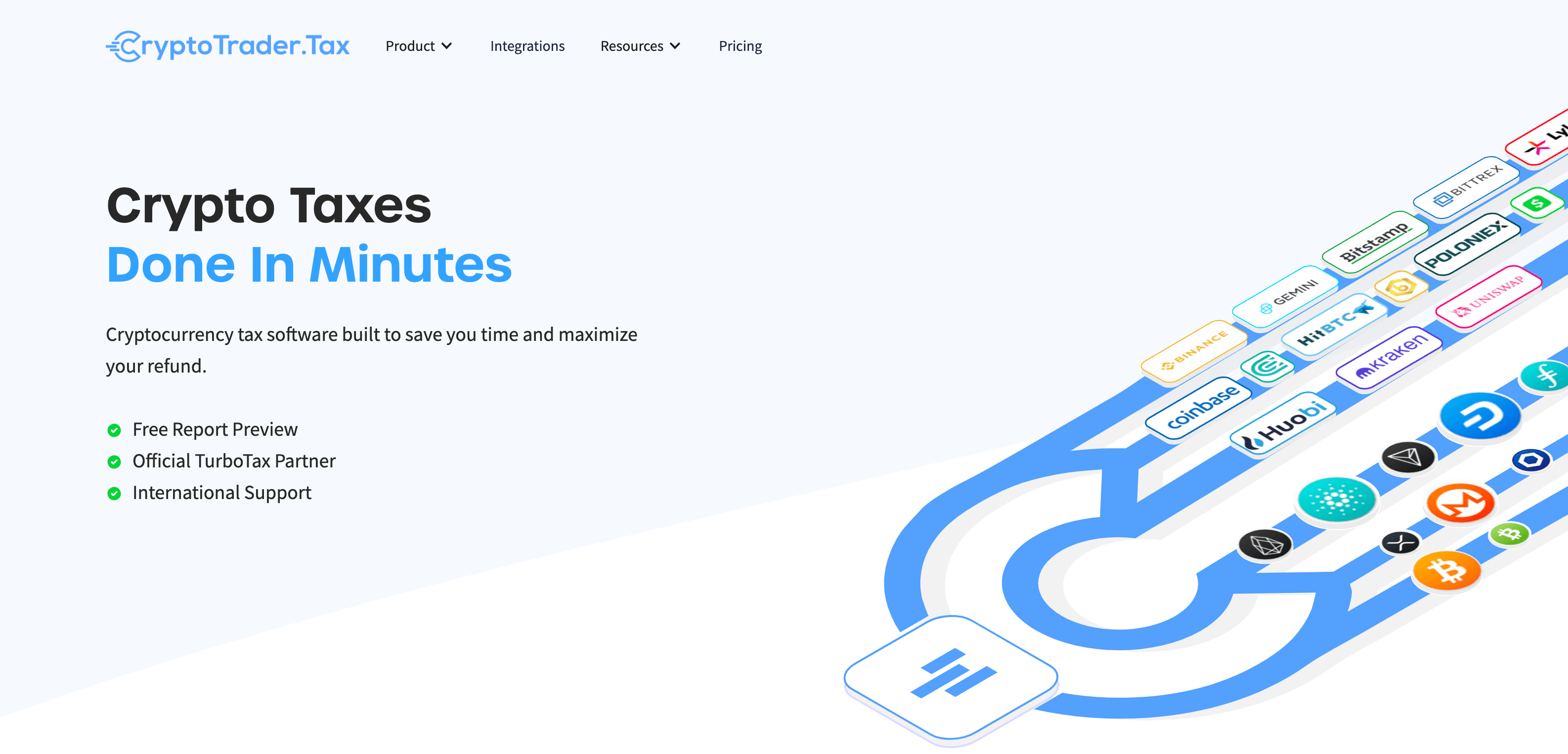

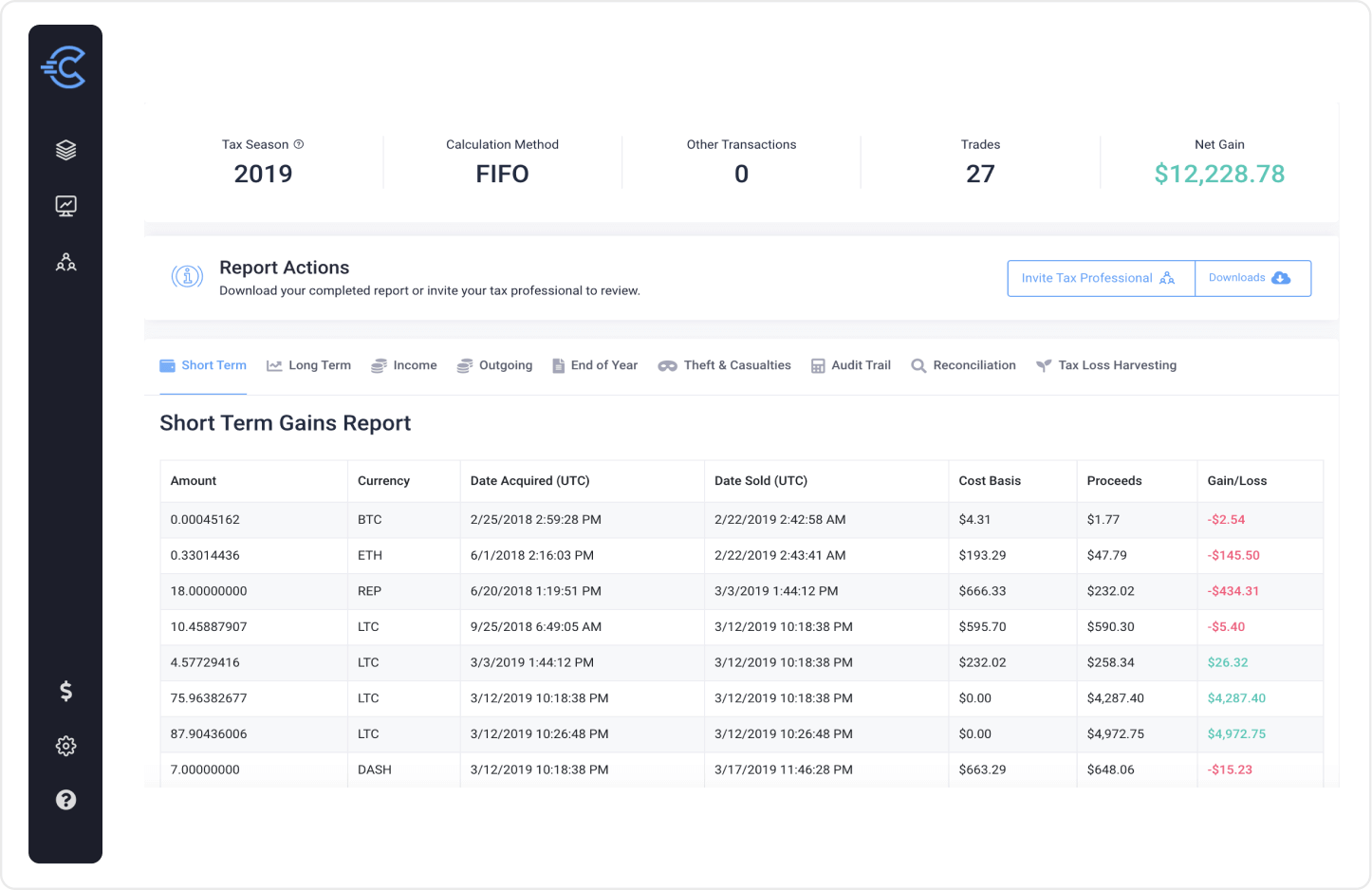

CryptoTrader.tax (CoinLedger) was founded in 2017, during a massive bull cycle, when early adopters faced problems reporting their taxes. Since its founding, the platform serves over 100,000 customers from its HQ in the US. CryptoTrader is also an official partner of TurboTax.

With CryptoTrader traders can automatically generate tax documents for their crypto holdings, including a complete IRS Form 8949, audit trail reports, crypto income reports, and an EOY positions report.

The platform lets users choose between different accounting methods such as LIFO (last-in, first-out) or FIFO (first in, first out) to help minimize taxes. To get started, one can easily import trades using API keys from exchanges (almost all exchanges provide these keys) and then generate a tax report in any desired world currency.

Exchanges supported include the largest like Coinbase, Gemini, and Binance, and even P2P platforms like LocalBitcoins. CryptoTrader also lets you import data from various wallets and DeFi protocols such as Uniswap.

Pricing for the service is divided into tiers. The most affordable option is the Hobbyist tier for $40 which covers 100 trades. The next tier, Day Trader, lets users import 1500 trades for $199 per tax season.

Anyone looking to import more than these can opt for the High Volume tier, suitable for professional traders tracking up to 5000 trades for $199. Lastly, the unlimited tier offers unlimited tracking for $299 annually.

CryptoTrader is a reliable, affordable service that simplifies the process of filing taxes, in particular thanks to the direct import option for TurboTax. With its tax-loss harvesting feature, it really helps with keeping the tax burden down. The only downside is that it just generates the appropriate forms for US reporting.

Accointing

Accointing is the youngest player under the crypto tax software providers. The company was launched in 2019 in Switzerland and promises to be an "all in one solution covering everything crypto and taxes."

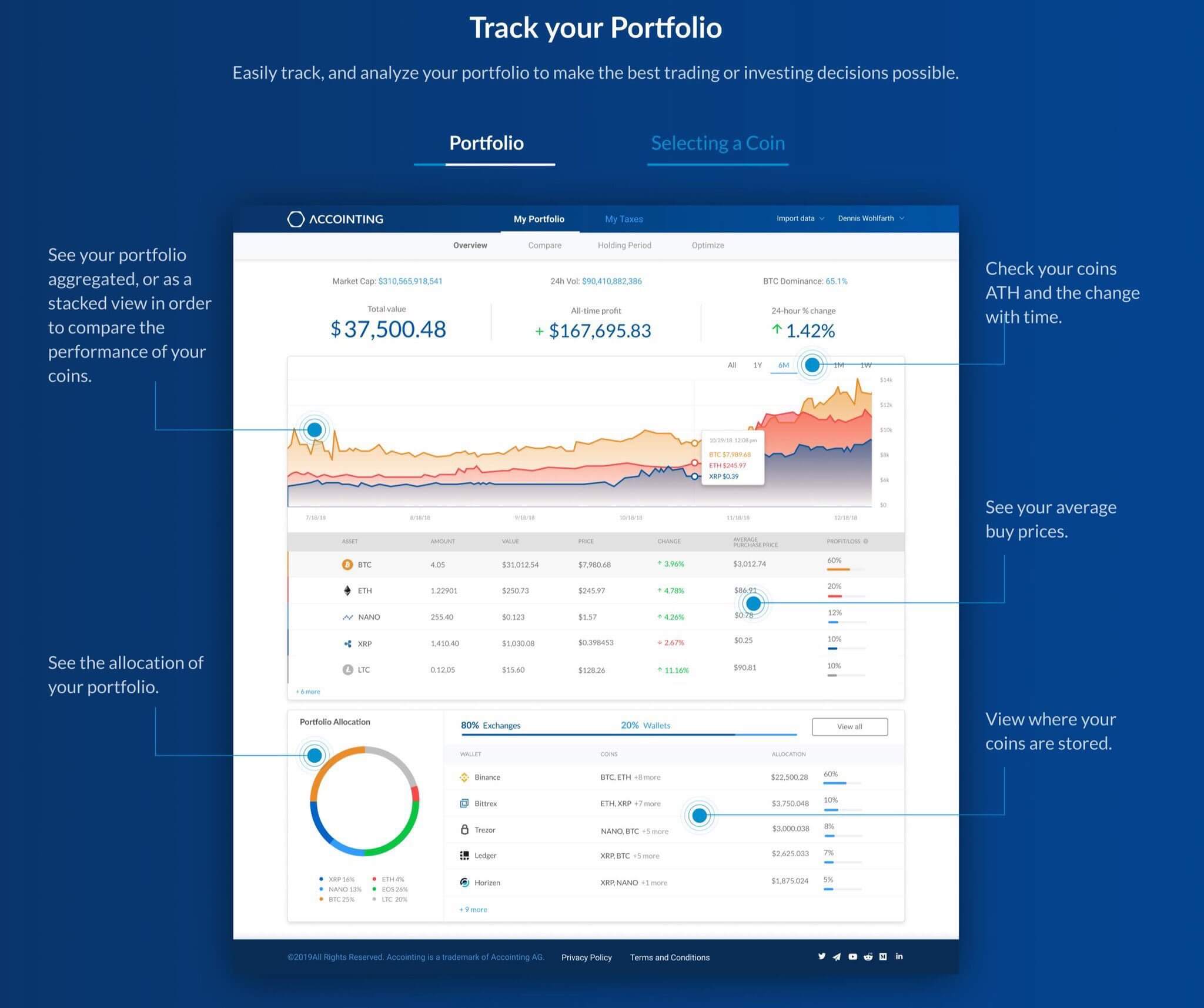

The user-friendly interface enables even those new to crypto taxes to generate the necessary tax information within just a few clicks. In addition to reporting taxes, Accointing includes a crypto portfolio management tool that provides traders with a very detailed view of the state of their portfolio at any timeframe.

The service offers recommendations for strategies like tax-loss harvesting based on one's holdings and the period one has held to keep the tax burden down. Currently, Accointing integrates with more than 300 wallets and exchanges.

The service comes with a convenient mobile app that gives users an overview of crypto prices, key market trends, and the ability to review their trades and transactions. However, importing data and generating tax reports is only possible from the website version.

Interestingly, Accointing also allows users to sync with other crypto portfolio tracking services like Delta and CoinTracking.

On the free plan, one can import 25 or fewer transactions which is a great incentive to just try it out, but for more active traders, probably not sufficient. The hobbyist plan covers 500 transactions for $79, whereas the Trader plan with 5000 transactions costs $179. With the Pro Plan, more active traders can track up to 50,000 transactions for $299.

The level of support depends on the subscription; Pro subscribers receive priority support. Overall, Accointing scores well on platforms such as Trustpilot and is an excellent option for new traders who want to try out a tool for their reporting.

Conclusion

I've introduced four different crypto tax reporting software options, and, ultimately, it always comes down to individual needs, such as the number of transactions supported, the country tax reports can be generated for, and integrations to exchanges and wallets.

Most of the platforms offer free trials, so when shopping for one, the best advice is to try before you buy.