Many underprivileged people living in low and middle-income countries depend on the money sent by their relatives living abroad, mainly in North America, Europe, and Asia.

Remittances are the money or goods sent by migrants who work abroad, to their families in their countries of origin.

Remittances represent the main source of income for many families in developing countries, and in some cases, they have also become an important part of the Gross Domestic Product of countries, such as El Salvador.

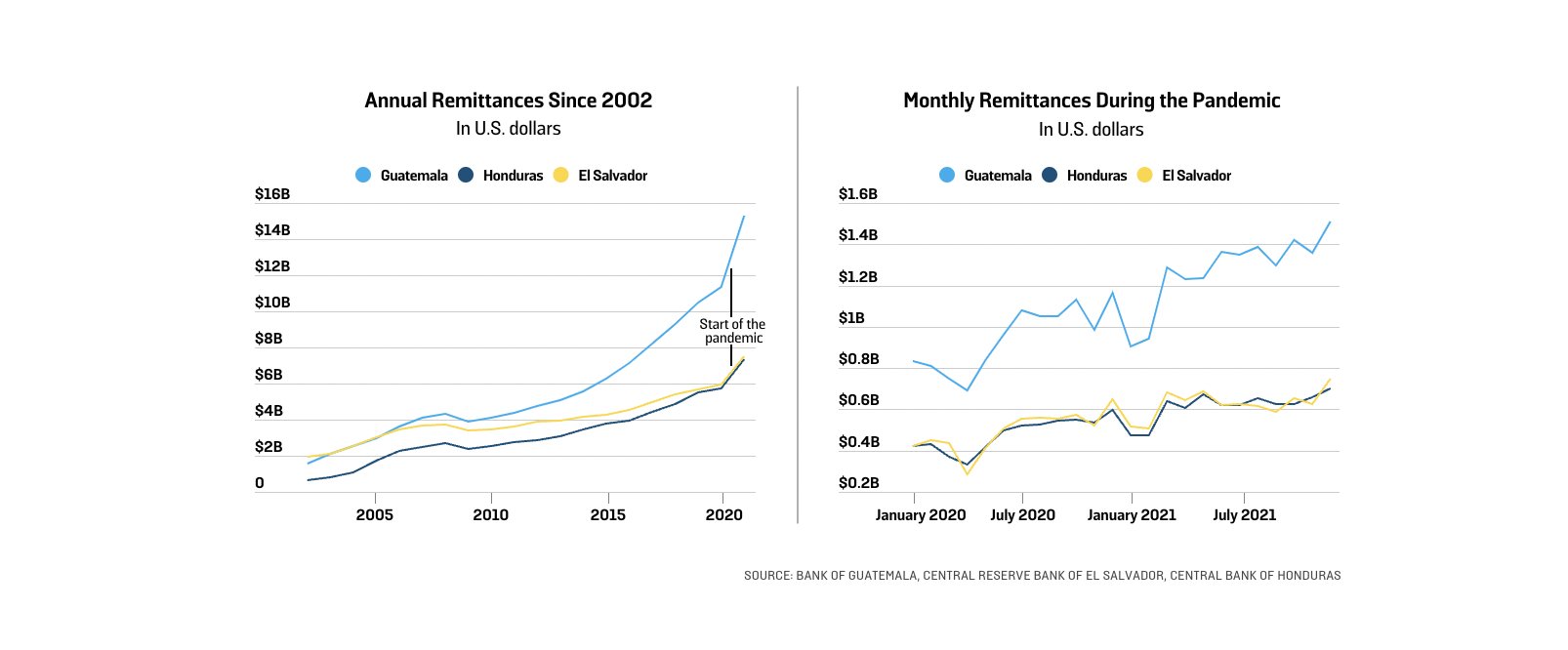

Since the start of the COVID-19 pandemic, remittances being sent to countries like Guatemala, El Salvador, and Honduras have smashed through records.

Sending money internationally has become increasingly important, and the most common way of doing it today is through electronic payments.

Facilitating the transfer of money from one country to another implies considerable disadvantages for the users involved. More than often they are faced with few options and exorbitant fees. Faced with these challenges, Bitcoin has emerged as a game-changer for remittances.

A brief history of remittances

Remittances aren’t something new. According to Esteves and Khoudour-Casteras (2011), in the 19th century, alongside the increase in migratory flows in Europe, remittances were used and had a complementary relationship with the economic and financial development of the recipient countries.

With industrialization, technological advances, and the expansion of the banking industry, remittances became increasingly common worldwide. Migrations were driven primarily as a result of political and socio-economic problems, such as poverty, hyperinflation, and the lack of jobs in remittances recipient countries.

According to a study from January 2021, at least 75 countries were registered as remittance recipients and another 30 as senders.

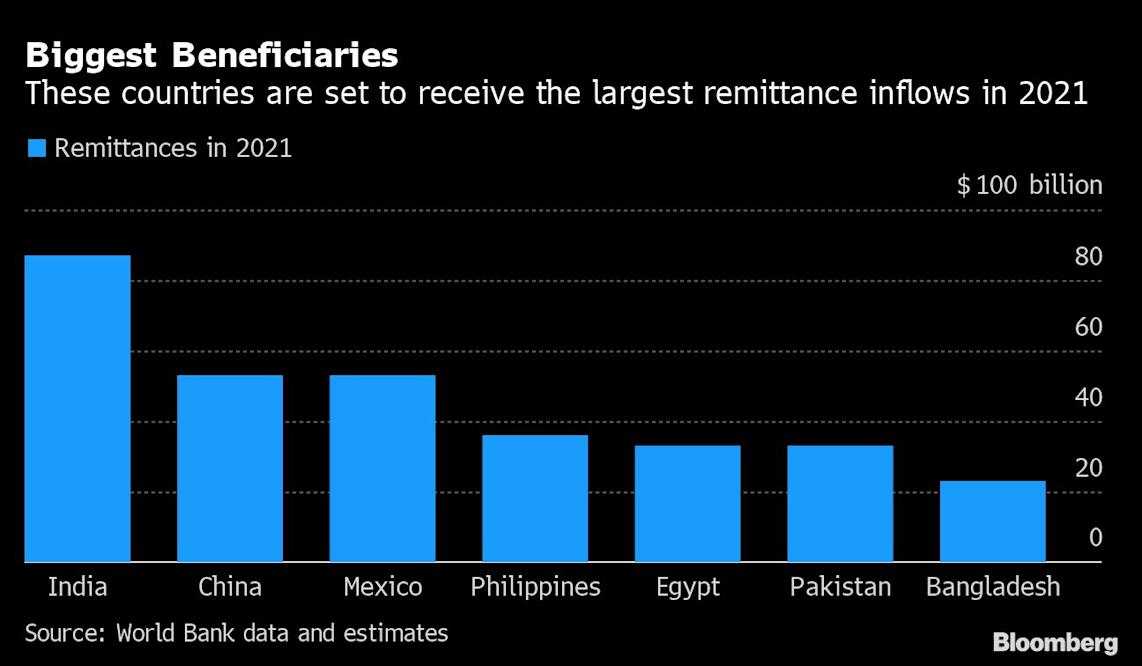

Likewise, according to the recent World Bank (WB) report about Migration and Development, the five main countries that received remittances in 2021 were India, China, Mexico, the Philippines, and Egypt, measured in terms of billions of dollars.

In terms of the ratio of remittances to Gross Domestic Product (GDP), five small economies ranked among the top in 2021: Tonga (44%); Lebanon (35%); Kyrgyz Republic (30%); Tajikistan (28%), and Honduras (27%).

The problem with traditional channels for remittances

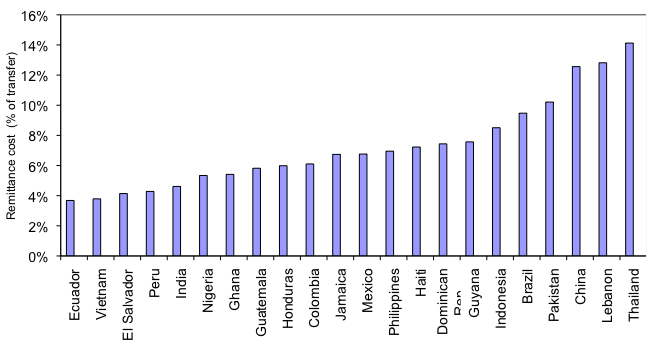

Sending remittances through formal channels raises various obstacles today. Not only is the requirement of an identity document hindering access to these services, but also the high fees of remittances. These fees reduce the benefits that families could receive, such as covering essential expenses for food, education, and health.

According to the World Bank, during the second quarter of 2021, a global average of 6.4% of total remittances were amounts of 200 USD.

It should be noted that in between the regions of Sub-Saharan Africa and South Asia live about 85% of the poorest people in the world. A decrease in remittance fees would make a massive difference there, where people survive on less than 2 dollars per day.

Unfortunately, SSA is the most expensive region to send money to globally, averaging 8.0% in fees. In contrast, in South Asia, the lowest cost was recorded, 4.6% in 2021, which is still very high (about 9.2 USD for every 200 USD), according to data reported by the WB.

The commissions for remittances tend to be higher when they are made through banks, compared to the rates of digital channels or through intermediaries. With a 6.4% global average rate, international payments between banks could be much more expensive.

High fees coupled with distrust in political figures and their controls, contribute to citizens such as Venezuelans preferring to send money to their relatives in Venezuela through informal channels. Channels such as unofficial exchanges, private third parties, or digital payments processors, getting rid of state mandates and their high costs on remittances.

There are also countries where remittances through official channels are restricted, such as North Korea. Despite this, informal intermediaries have managed to escape state controls to send remittances from South Korea and China, but at high costs and risks.

There are also cases where services like Western Union ceased operations in countries like Cuba due to the sanctions imposed by the United States.

Western Union, along with MoneyGram, also stopped its services in Afghanistan, where banks also imposed strict restrictions on withdrawals, after the Taliban’s takeover.

Informal channels also have their disadvantages: commissions can be high even if they are lower than those of formal channels, and there is a risk that clients may be scammed. Also, both formal and informal channels are not always available to everyone.

How bitcoin is solving remittances

Bitcoin has quickly become the game-changer of remittances.

Thanks to Bitcoin's decentralized network, today it is possible to send remittances practically instantaneously and at a very low cost. Using bitcoin, beneficiaries get rid of many obstacles associated with sending money with fiat currency and with traditional channels.

If a remittance is sent through the Bitcoin Network, a user should probably wait for the transaction to be included in a block (about 10-30 minutes). In this network, the minimum fee is 1 sat / vBytes, and estimating that a native SegWit transaction is 140 vBytes, the remittance would have a fee of 0.06 USD.

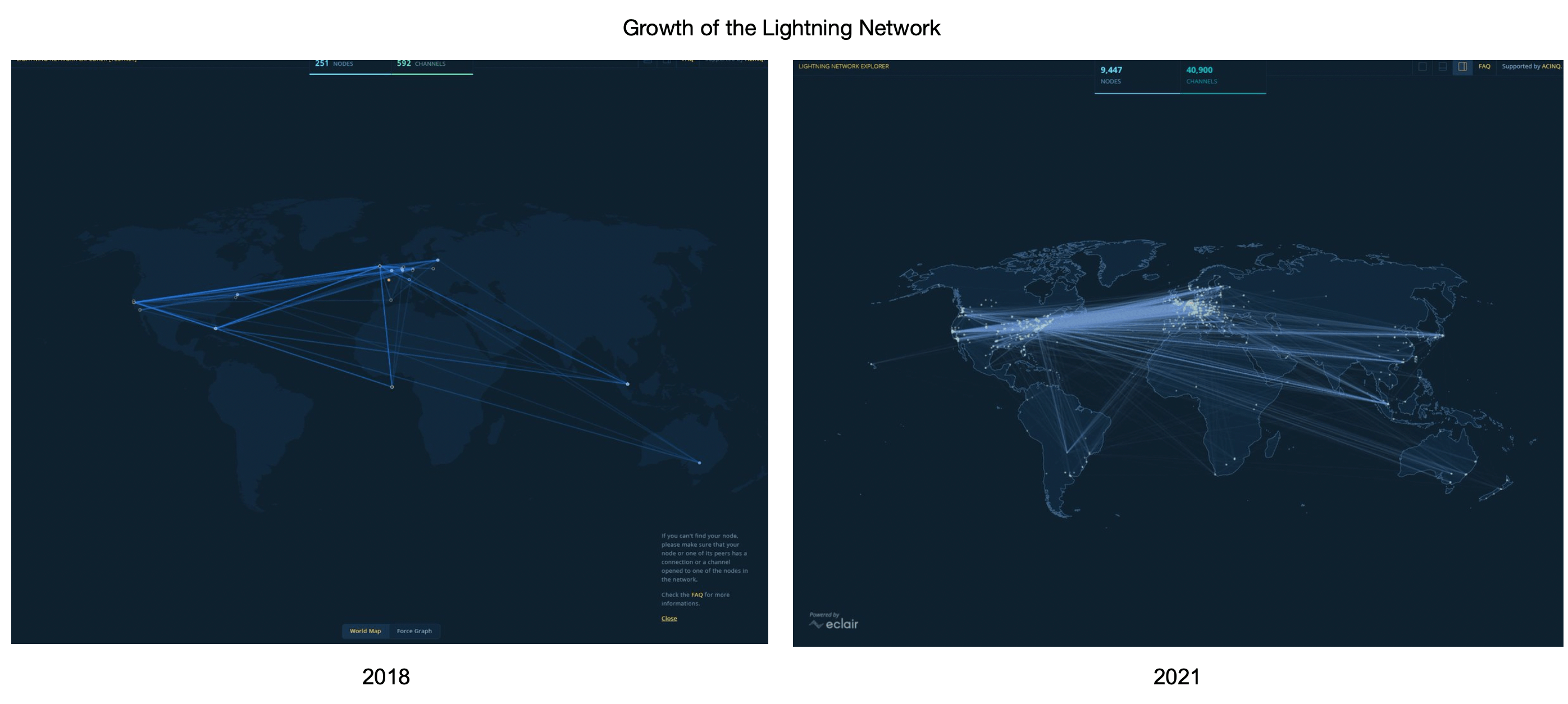

In the case of using the Lightning Network, a second layer on top of Bitcoin, a BTC transaction would be carried out instantly and at a much lower cost, 1 sat or sometimes even nothing.

Bitcoin adoption is trending faster largely due to increased usage of the Lightning Network for activities like social media and gaming, remittances, e-commerce, and earning.

In the world of Bitcoin, there are no borders, there are no procedures or requirements in order to send money from one place to another. To send remittances with Bitcoin it is not required to share your identity or present documentation.

There are no restrictions or prohibitions by nationality, age, occupation, or amount. With Bitcoin you don't need a bank account either, just a smartphone with an Internet connection is enough to get started.

In addition, both the main Bitcoin Network and Lightning are always available, there are no holidays for the network, so the remittance could be sent at any time, and be received in a matter of seconds.

As bitcoin is a currency without the brand of a particular country, it is not subject to the controls of any State, and it is also indifferent to sanctions and restrictions for international trade.

Bitcoin for remittances

Last year, El Salvador made international headlines by recognizing bitcoin as legal tender.

The main argument that the President of El Salvador, Nayib Bukele, gave when he presented The Bitcoin Law was the impact of Bitcoin on remittances.

Bukele claimed that with Bitcoin, Salvadorans can save 400 million dollars that they spend each year for the fees accumulated from remittances companies, such as Western Union. Remittances in El Salvador represent 26% of its GDP, making it the 6th country in the world that depends mostly on remittances, and the second in Latin America, after Honduras.

Chivo ATMs have been installed across El Salvador to offer zero-commission transactions, and are targeted as a way to cheaply transmit money across the border.

In December of last year, the Central Reserve Bank of El Salvador (BCR) reported that remittances received during 2021 grew 28.1%, compared to 2020.

Venezuelans have also been using bitcoin for years, mainly as a form of protection from hyperinflation and poverty.

With the national blackout in March 2019, the influence of Venezuela in the Latin Bitcoin market was evident. Reports inferred that Venezuelan migrants would be using bitcoin as a way to send remittances home, even from other Latin American countries where migrants are settled like Chile.

Additionally, countries like India and Mexico not only stand out in receiving remittances but also in their quick adoption of Bitcoin. It is also in the midst of a deep economic crisis, more and more people in Lebanon are interested in Bitcoin.

The 2021 Global Crypto Adoption Index of Chainalysis found that Central and Southern Asia, Latin America, and Africa use Bitcoin primarily for remittances. In Nigeria, official remittances fell significantly by 27% and it is presumed that this is because the Nigerian diaspora would be using Bitcoin to send money to their families.

Bitcoin has changed remittances and payments drastically as we knew them a decade ago.

Bitcoin is gaining more ground every day among migrant workers around the world who send support to their countries of origin.

In countries with populations affected by political, social, and economic problems, Bitcoin is bringing aid directly to its beneficiaries, at any time and at practically no cost.