Falling down the proverbial Bitcoin rabbit hole will inevitably lead you to come across the term Austrian Economics.

The Austrian School of economic thought has a few key aspects:

- A focus on individualism and humans as acting agents

- Appreciation for free markets

- Central planning causes distortion and is inefficient

- Sound money, economic freedom, and a general suspicion of government intervention

As such the Austrian School of Economics is in line with Bitcoin’s core principles.

Generally considered to be a heterodox school of economic thought, the Austrian School was originally founded in the Austro-Hungarian Empire during the 19th century.

While no one would have referred to these early avant-gardists – mainly comprised of legal scholars, journalists, and public officials – as founders of an economic school back then, they later came to be known as the first generation of Austrian economists.

Famous Austrian Economists - Source

Most famously among them is Carl Menger who is commonly considered the founding father of Austrian Economics. Other famous Austrian scholars are Friedrich von Wieser, Eugen von Böhm-Bawerk, Ludwig von Mises, and Friedrich Hayek.

They were either direct students of Menger or students of his students, carrying on the tradition that creates the basis of the Austrian School of Economics.

In mainstream circles, Friedrich Hayek is the most widely known Austrian economist, having won the Noble Prize in Economics in 1974. Hayek is also known to have been the intellectual antagonist of one of the 20th century’s most famous economists, John Maynard Keynes.

Although Keynes did not really seem to care about Hayek’s criticism and Hayek did not really think highly of Keynes as an economist, their names have coined opposing poles of economic thought, conjuring the clash of Keynesian vs Austrian schools of thought.

Keynes vs Hayek - Emergent Order

Asking your typical mainstream economist, the response would be that Keynes has won the battle. After all, Keynesianism has turned out to make up an essential part of today’s economic curriculum taught at schools and universities.

Austrian Economics on the other hand has barely managed to gain any recognition within the broader sphere of economic science – which is a blessing some would argue.

Influential fringe within the modern world

Outside of Bitcoin, Austrian Economics is commonly criticized as being merely an intellectual exercise revolving around hypothetical thought experiments.

Since its beginning, the Austrian School has been underestimated in its practical relevance. But, if one looks closer, it’s hard to ignore the impact that people inspired by Austrian Economics have wielded on the world.

Take for example Chaos theory, an ever more popular branch of science that studies complex phenomena of all kinds. Its relevance lies in the fact that understanding this theory can help humanity leapfrog new kinds of developments, which begin by going beyond classical linear mechanics.

The connection to Austrian Economics might not be as straightforward as with other fields but it was the Austrian scholars that discovered that the modern world is experiencing a new qualitative dynamic resulting from its ever-greater complexity.

As a consequence, they realized that in order to understand this complexity of feedback loops and reflexivity, a bottom-up approach studying human action is needed. Through this realization, they paved the way for new non-mechanical fields of science like complexity theory or quantum mechanics.

In 1964, Friedrich Hayek published an essay, “The Theory of Complex Phenomena" that can be considered to be co-responsible for igniting further interest in complexity theory. Already before Friedrich Hayek, Carl Menger stressed the importance of spontaneous order in approaching and analyzing social phenomena.

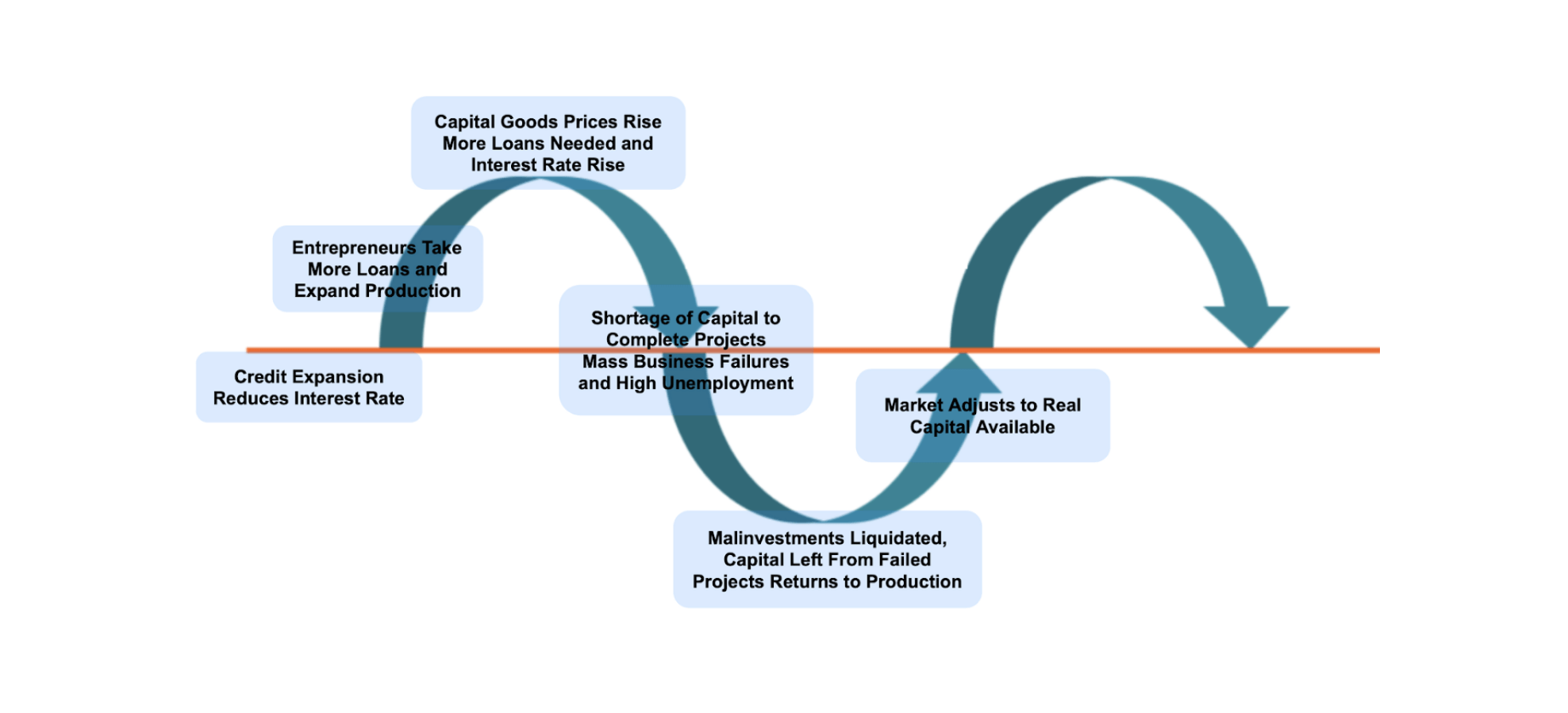

Austrians also claim credit the laying groundwork for understanding how business boom/bust cycles work. Aptly named, "the Austrian business cycle theory", the theory explains that booms are caused by an expansion of credit, while busts are caused by a contraction of credit.

A more mundane tool that can be linked to the thinking of the Austrian economist is the Internet’s most famous encyclopedia Wikipedia. Its founder Jimmy Wales has stated that he was heavily influenced by Friedrich Hayek’s paper “The Use of Knowledge in Society” when he thinking of the decentralized governance of Wikipedia.

It's also within the wider field of economics that the Austrian economists have left marks that are underappreciated.

The theory of entrepreneurship was neatly sketched out by Israel Kirzner. The philosophical and practical foundations of the modern business corporation were laid by Peter Drucker, who was himself highly influenced by the Austrian School.

And last but not least, the theory of money has almost entirely been concocted by Austrian Economists like Carl Menger and Ludwig von Mises.

As a matter of fact, the Austrian School’s influence on many of the most prevalent topics in our modern world might not be recognized as such, but is quite heavy and substantial when given a second look.

So, whether you want to believe it or not, the Austrian School may be fringe, but an influential fringe nonetheless.

The digital manifestation of Austrian Economics

The latest recognition boost to the Austrian School was the immaculate conception of Bitcoin.

Just as Wikipedia seems to be a real-world implementation example of Austrian Economics, Bitcoin is widely considered to be a real-world implementation of the numerous findings of the Austrian School's understanding of money.

When the Bitcoin whitepaper was presented to the world through a mailing list consisting of cryptographers, cypherpunks, and libertarian-minded people, the financial crisis of 2008 was underway.

By embedding the message “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” into Bitcoin’s genesis block, the cryptocurrency’s pseudonymous creator, Satoshi Nakamoto, subtly revealed his critical stance towards government intervention of money.

Bitcoin Genesis Block RAW data

One month after Bitcoin’s launch on January 3rd, 2009, Satoshi made another striking appearance on a web forum.

In an eloquent paragraph, he pointed out that neither central banks nor commercial banks have historically been trustworthy in terms of managing money. By describing the government’s stranglehold on money as the root problem of conventional money, Satoshi hinted at his personal affinity for the idea of sound money, something near and dear to the Austrian School.

As for any direct influence of particular Austrian economists on Nakamoto, that can only be speculated.

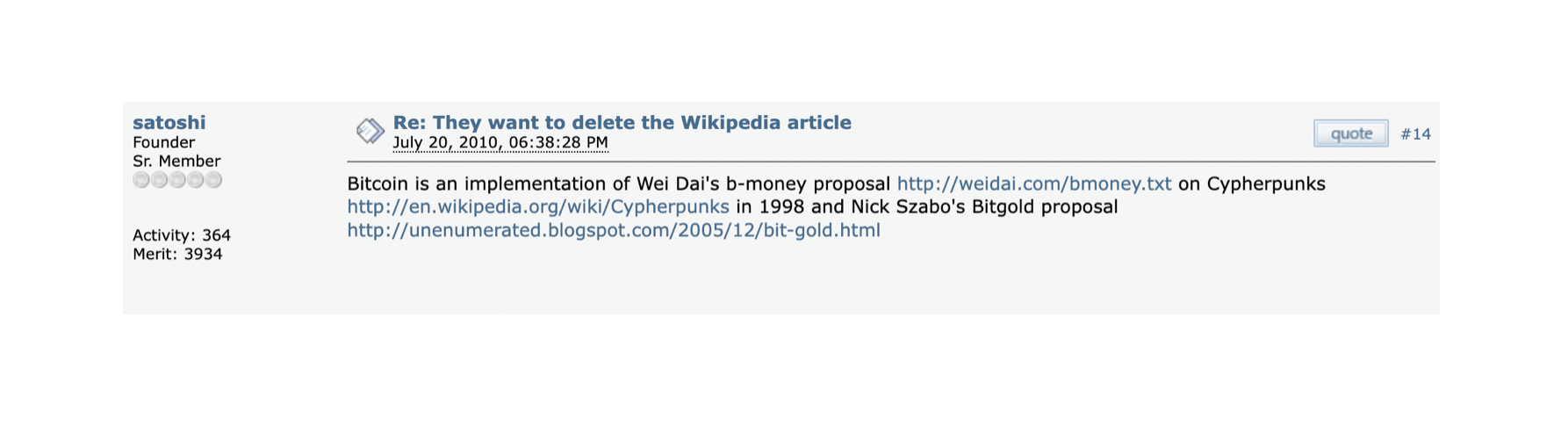

While it's hard to think that Bitcoin's founder must not have had any knowledge of Austrian economics, the closest link that can be established is through cypherpunk and cryptographer Nick Szabo, who Nakamoto has referenced.

Satoshi mentioning Nick Szabo's Bitgold proposal - Source

In one of the Bitcoin community’s most widely known pieces, “Shelling Out: The Origins of Money”, published in 2002, Szabo references Carl Menger.

Austrian skepticism towards Bitcoin

Interestingly, despite the philosophical similarities and possible connections, many of today’s adherents of the Austrian School remain(ed) skeptical about Bitcoin.

Already at a time when Bitcoin was hardly known to the general public, the cryptocurrency sparked fierce discussions among those who consider themselves contemporary Austrian economists.

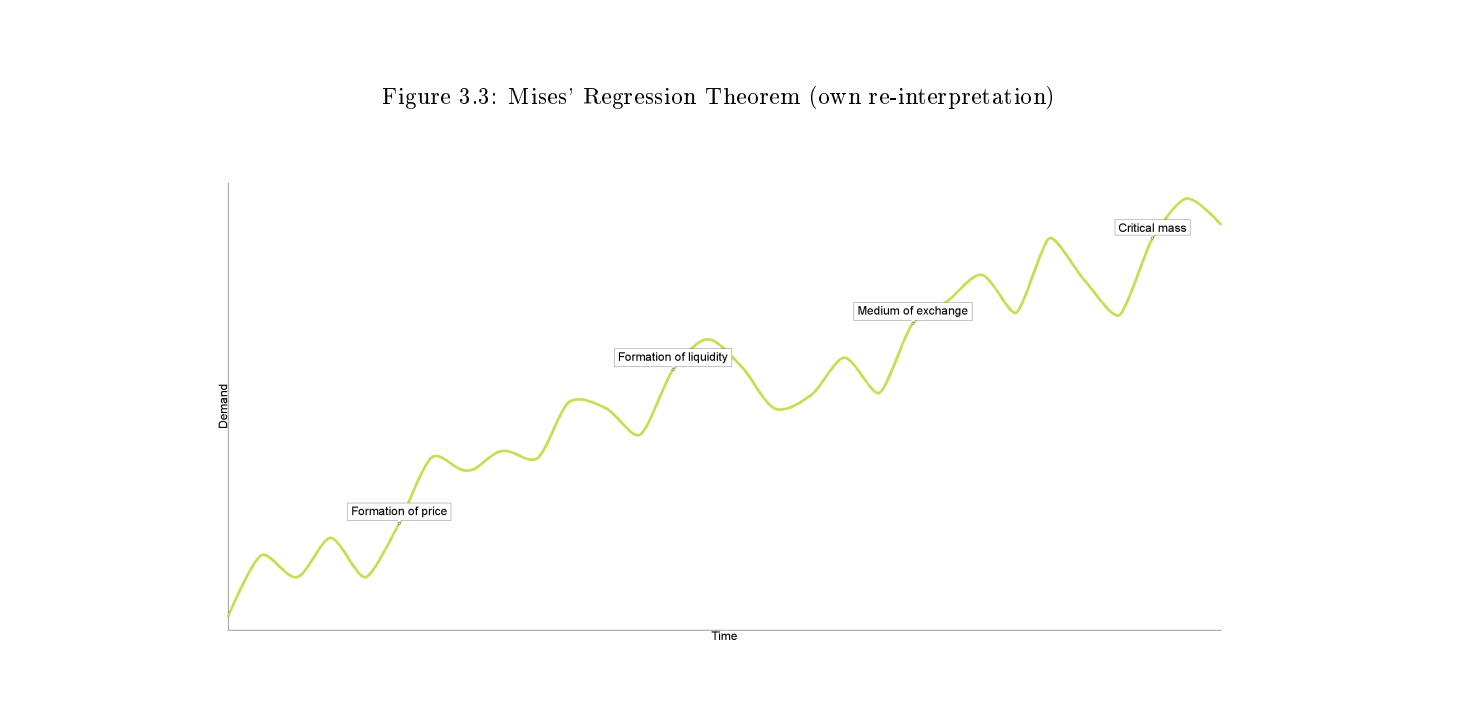

A popular question raised during debates was whether or not Bitcoin passes the Regression Theorem. This theorem serves as an intellectual help to understand the origin of (a) money.

After all, the question of why money has value in the first place has bothered economists for ages, especially since the answer seems circular. Money is in demand because it has high purchasing power and this high purchasing power is a result of its demand.

It was Ludwig von Mises, who was able to resolve the circularity. He argued, to understand how value manifests, one has to go back in history (regression). Today's demand for money depends on yesterday's purchasing power of money.

By regressing all the way to a (hypothetical) beginning, money must have already had a specific commodity- or use-value when it entered its discovery process, which is why it was demanded in the first place.

Thumbs-up from Ludwig von Mises

On the surface, it seems that Bitcoin violates the regression theorem because Bitcoin would first have to be valued for its direct utility before it could hold indirect exchange value. But this was later proven to be incorrect with an AIER research article describing the high-level debate.

Critics were mainly relying on an interpretation of the Regression Theorem, formulated by Murray Rothbard (one of Ludwig von Mises’ most famous students) for their dismissal of Bitcoin.

As Rothbard noted, money can only emerge as a unit of weight of a useful market-produced commodity, which is almost always either gold or silver.

Deducing from this point of view, several Austrian Economists failed to see bitcoin as having any use-value as a commodity that could serve as a foundation for its establishment as money (according to the Regression Theorem).

Other proponents that have been associated with the Austrian School argued in defense of Bitcoin, stating that the cryptocurrency is in line with the Regression Theorem.

According to Konrad Graf, Bitcoin’s non-monetary use can be derived from the cryptocurrency having served as a technological gimmick in the field of monetary theory, indicating allegiance and commitment to a special cause – that of potentially changing money.

This argument was reinforced by Peter Surda in the 4 points he makes:

- Once a medium of exchange is sufficiently liquid, it can, hypothetically, sustain itself through the network effect even if it does not have non-monetary uses, as liquidity creates demand

- Before a medium of exchange is a medium of exchange, it must be liquid

- Before it is liquid, it must have a price

- Both of these are fundamentally market phenomena, i.e. both price and liquidity must be established as a catallactic process

Mises' Regression Theorem (Surda's re-interpretation)

By making this argument, Surda was drawing attention to the Austrian concept of entrepreneurial foresight, explaining how people with an entrepreneurial mindset value seemingly invaluable things in anticipation of them becoming valuable one day.

Surda states that even though early acquirers of Bitcoin could not have been sure of any future demand, they must have rationally concluded that the price demanded by potential future buyers will exceed the price demanded by producers, which is why they saw initial value in departing with their fiat money in exchange for Bitcoin.

A turning point in monetary theory

So, does Bitcoin violate the Regression Theorem? When applying the very narrow view of Rothbard, it is rather hard to square Bitcoin with the theorem.

Shifting attention away from the rigid term of use-value though and understanding value more broadly as being fundamentally subjective in nature – a core Austrian concept – one can make the case for bringing Bitcoin in line with Mises’ theorem.

As a matter of fact, use-value, more broadly grasped in accordance with the theory of subjective value, can primarily be psychological or sociological in character.

In a sense, the utility of Bitcoin and its use-value could have come from the fact that bitcoin (the asset) was considered a way to participate in the early societal experiment, which Bitcoin (the network) was formulating.

Evaluating the (use) value of (a) money in terms of the subjective theory of value is one thing. The other thing is to break away from a very materialistic world view, in which commodity money necessarily needs to be of physical substance.

While this was considered a prerequisite for Mises and other Austrian Economists, they were not able to picture any other reality (technological progress in their day and age was not yet as advanced as today).

Today, we have to acknowledge the fact that Bitcoin is currently demonstrating with ever more certainty, that fiduciary money (Zeichengeld) as defined by von Mises can synthetically, i.e. technically imitate commodity money successfully. Most certainly, this would be acknowledged by people like Mises himself.

Relationships between some of these terms in professor Mises' system - Source

This being the case, it is crucial to recognize that the essence of commodity money is not its physicality or materiality. Rather, the existence of rising marginal costs in production, or what Nick Szabo called unforgeable costliness attached to synthetic commodity money.

While synthetic commodity money really seems to be a thing, some Austrian economists were also skeptical about Bitcoin, precisely because of its psychological use-value in granting access to a sociological experiment among like-minded Libertarianism.

It is undeniable that Bitcoin started as a sort of collectible within a highly distinct tribe consisting of Libertarians and Cypherpunks. In that respect, Bitcoin was quite antithetical to what Austrian Economists understand money to be: an abstract mediator of value in-between unrelated strangers. Money’s prime function is really understood to be a universal medium of exchange unattached to any ideological underpinnings.

As it stands today, Bitcoin has proven this criticism to be false.

While Bitcoin still has its ideological roots and a vibrant community of so-called Bitcoin maximalists eagerly trying to perpetuate these roots, Bitcoin has managed to convince a broader set of people of its value.

Be it left-wingers, traders, bankers, government officials, or just everyday people, unbiased users find themselves using Bitcoin as a means of payment because of a lack of real alternatives. Bitcoin is ever more morphing into a universal medium of exchange that is mediating between strangers.

Bitcoin’s connection to Austrian Economics

With all of this being said, the concluding question is: Can Bitcoin be considered a product of Austrian Economics applied? Yes and no.

It is certainly true that many ideas commonly associated with Austrian Economics like free-market sound money, free banking, a critical stance towards state interventionism (Keynesianism), and the denationalization of money, can be linked to Bitcoin.

As a matter of fact, there is even a debate going on whether Austrian Economics is the originator and growth engine behind Bitcoin or whether it is the other way around and Austrian Economics is impossible without Bitcoin?

While the connections and tensions are conspicuous, calling Bitcoin an invention of Austrian Economics is too much of a stretch. Most notably, it would be a proposition that the “real” Austrian economists like Menger, Mises, or Hayek would most likely not endorse themselves.

As they understood their profession, Austrian Economics is neither a socio-economical nor political template for the human organization of any sort.

Menger, Hayek, and mainly Mises have put great emphasis on practicing a value-free (wertneutral) approach to economics and social phenomena. They were not eager to design or structure the world through technocratic design following an economic or political ideology that could be referred to as Austrian Economics.

Their desire was much more to understand the world from first principles applying a praxeological way of thinking in studying human behavior.

This approach was certainly applied leading up to the discovery of Bitcoin. As some Bitcoiners argue, Bitcoin has not been invented, but discovered, by studying the world and applying a trial and error mentality that eventually led to the creation of Bitcoin.

Also, the proliferation of Bitcoin has been happening according to an emergent spontaneous phenomenon that is evolving evermore. In that sense, Bitcoin is truly a spontaneous phenomenon.

It's important to note that Bitcoin is not evolving according to a political scorecard concocted by an ideological party called the Austrians, but according to complex factors making up human beings as living agents.

These principles were studied and described by Austrians, leading opponents to speculate that these principles must somehow be the core principles defined by Austrian economics. In actuality, these economists were just trying to apply an objective and unbiased lens to understanding the world around them.

By studying Austrian Economics in its original intent more closely, one inevitably studies the world more closely.

As Bitcoin is becoming an ever more integral part of human affairs (one that is particularly badly understood by conventional economic theory because Keynesianism and other economic schools are more about modeling than understanding), it makes all the more sense to turn to Austrian Economics to better comprehend and interpret this most interesting monetary phenomenon developing before our very eyes.