The separation of money and State was a farfetched theory until Bitcoin came along in 2009.

And when it comes to cryptocurrencies today, most people are introduced to them by learning about Bitcoin first. This is no coincidence.

Bitcoin is considered to be the first, most decentralized, and most well-known cryptocurrency of the more than 20,000 coins that exist today.

While Bitcoin is indeed the gateway drug into decentralized currencies for most people, just as many enthusiasts and newcomers want to know about other cryptocurrencies and Bitcoin is thought to be just one among the many other thousands of iterations.

Within the rapidly growing cryptocurrency sector, the perception that Bitcoin competes within the broader sector is being perpetuated by investors, researchers, influencers, and educators alike.

We're here to say that this is entirely inaccurate and disingenuous.

A thorough understanding of Bitcoin, its’ history, and other cryptocurrencies reveal, that Bitcoin is in a league of its own and cannot be seriously lumped together with other cryptocurrency projects.

This is because Bitcoin is competing to be the first globally accepted, politically neutral, decentralized money. The significance, but also the challenge, of realizing this endeavor is displayed by the fact that in all of mankind’s history, it has only ever been achieved by precious metals like gold and silver.

Bitcoin is built differently

The lofty objective of globally accepted sound money separates Bitcoin from the many different cryptocurrency projects, most of which are not even trying to be currencies, let alone money. Yet, Bitcoin must also be distinguished from cryptocurrencies that purport to aspire to be money.

In terms of the many fundamental qualities a globally accepted, politically neutral money must possess, none of Bitcoin’s cryptocurrency competitors are as decentralized, leaderless, dispersed, trust-minimized, and ultimately, as neutral as Bitcoin.

Technically, the various characteristics of sound and compelling money – carefully laid out by the Austrian School of Economics – can be implemented by other cryptocurrencies.

Hypothetically it is even possible that a Bitcoin contender could optimize on these characteristics. But, ultimately, to reliably implement such characteristics, maximizing trust-minimization is essential.

As such, trust-minimization is the essence of security. The more trust-minimized a cryptocurrency, the less a user has to trust anyone that the cryptocurrency will function as designed.

This is an essential prerequisite for neutral money. For money to be neutral, it needs to be as trust-minimized as possible. As it stands, no other cryptocurrency currently has a more trust-minimized technical setup, which makes Bitcoin’s aspiration of becoming a globally accepted, politically neutral money the most convincing.

Although this fight for a most trust-minimized implementation of sound money characteristics will always go on, Bitcoin had a unique head start.

In comparison with Bitcoin, no other cryptocurrency project has managed to decentralize and trust-minimize its conception, thereby making its economic game theory the most persuasive.

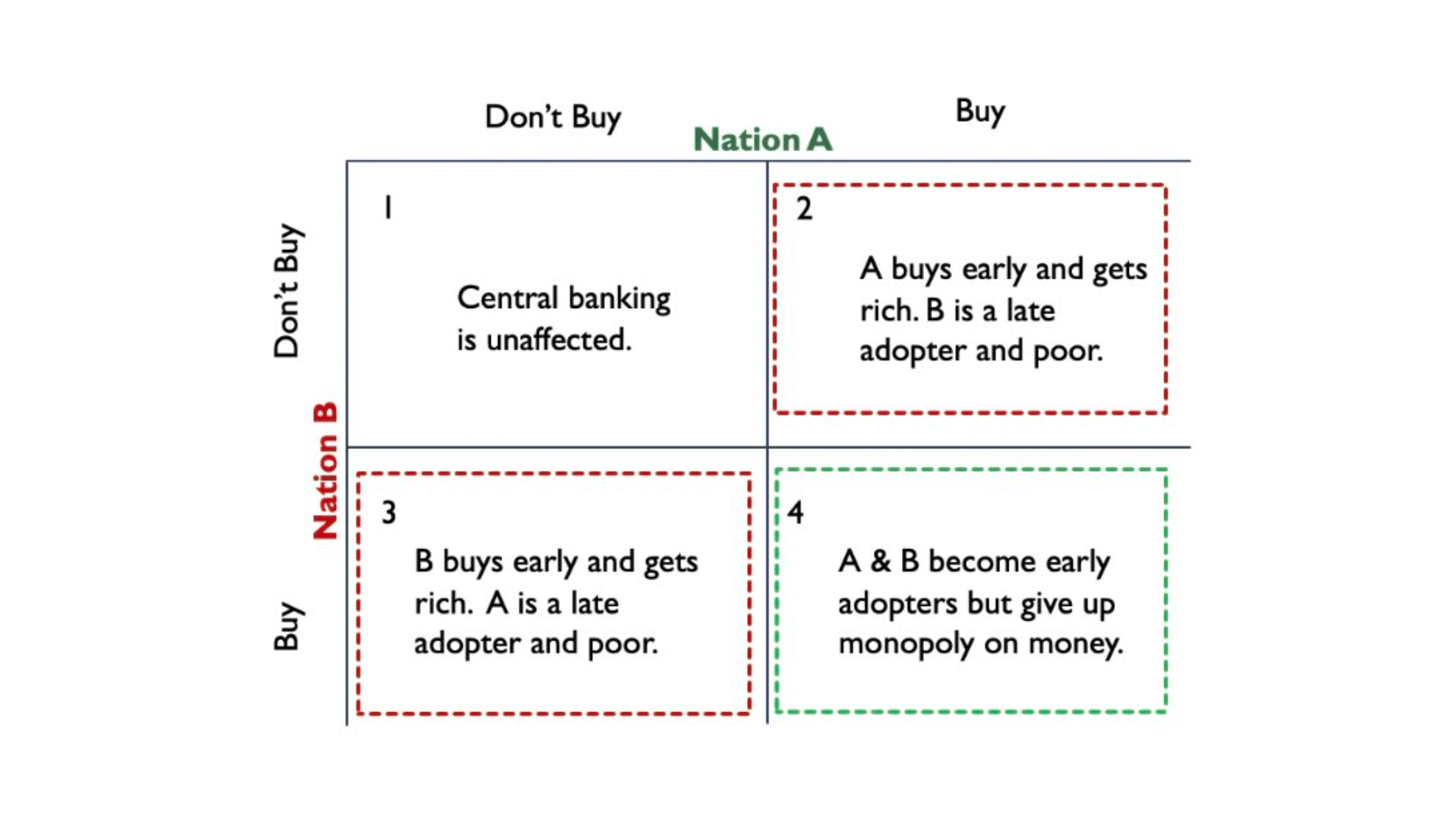

Bitcoin nation-state game theory. "Even if other countries do not believe in the investment thesis or adoption of bitcoin, they will be forced to acquire some as a form of insurance."

Or said differently: No other project has been born into more favorable circumstances than Bitcoin, allowing it to grow vastly undetected from politically influential interest groups or well-financed stakeholders seeking private allocations.

What’s more: It is hardly conceivable that any other cryptocurrency project could more thoroughly trust-minimize its conception today. While the technical implantation of the characteristics of sound money could perhaps be optimized with any modern cryptocurrency compared to the ones implemented in Bitcoin, working towards a more decentralizing and trust-minimizing conception is virtually impossible.

Bitcoin’s immaculate conception cannot be replicated. Let’s explore why.

Decentralizing the social layer

Indeed, if one contemplates Bitcoin’s conception, its immaculacy is truly astonishing.

Bitcoin was launched anonymously by a pseudonymous individual called Satoshi Nakamoto, who to this day, has apparently never monetized any of their billions of dollars in lucrative gains.

Satoshi did not give themselves any special privileges when it comes to accessing Bitcoin as Satoshi had to mine the currency, when it launched, just like any other market actor.

This was also done in an environment where cryptocurrencies didn't exist, so there was no mass rush to buy up bitcoin. The currency circulated without a value for almost 1.5 years giving it wide distribution amongst those that didn't seek monetary gains.

Satoshi having operated under a pseudonym as an anonymous makes some people question Bitcoin’s integrity as a system.

Why trust a system, whose founder is not even known?

Indeed, Bitcoin is represented by a mere program of abstract code lines. Dealing with such a high level of abstraction represents a challenge to humans as we are naturally looking for concrete references and tangible points of contact that help us identify.

Without any point of reference, transparency becomes indispensable. Thus, Bitcoin is structured as openly verifiable lines of code.

Although this code was originally written by Satoshi, he or she is no longer essential for the continuation of Bitcoin.

As such, the concept of Bitcoin can be compared to the Pythagorean theorem or Euclidean geometry. While both are indispensable frameworks in mathematics, architecture, and engineering today, they are still being used even though the creators behind these formulas and concepts are only known from history books.

Not only is Satoshi’s involvement not crucial for the long-term persistence of Bitcoin, his or her anonymity ultimately underscores the integrity and (value) promise of Bitcoin as an idea.

By remaining anonymous (and disappearing), Satoshi detached Bitcoin from any single point of attack on the social layer adding to the system’s overall trust-minimization.

Not disclosing their identity meant that Bitcoin could not be disrupted by destroying or manipulating its founder through prosecution, torture, blackmail, or extortion. Especially in the early days of Bitcoin, when the network was not very widespread and therefore not very secure, any preemptive attack to nip Bitcoin in the bud by bringing down its founder was impossible.

A mythical act of creation

Satoshi made sure to leave as little personal information about themselves as possible.

Only a few people ever communicated with Satoshi over the internet directly. These few figures are now viewed as legends in the space of cryptocurrencies (Hal Finney, Mike Hearn, Gavin Andresen, Adam Back, Wei Dai).

One cannot help linking Bitcoin’s origin story to the pervasive religious story of Jesus. Much like Jesus taught his chosen disciples for three years, Satoshi gathered a few core developers that would eventually maintain Bitcoin.

And just like Jesus miraculously ascended to heaven one day, Satoshi vanished as mysteriously as they appeared. On April 26, 2011, Satoshi sent his or her last message to Gavin Andresen without any final glorious speech or farewell announcement.

"I wish you wouldn’t keep talking about me as a mysterious shadowy figure, the press just turns that into a pirate currency angle. Maybe instead make it about the open source project and give more credit to your dev contributors; it helps motivate them."

Satoshi then simply stopped writing.

By disappearing the way they did, Satoshi truly coined Bitcoin’s mythical act of creation.

For true Bitcoin devotees, he or she is not just the reclusive computer genius behind Bitcoin, but a sort of personification of a higher power that laid down its active role and now lives on in their minds as an almost Promethean-like figure.

"In the beginning, God created the heavens and the earth," it says in Genesis, the bible’s first book. And Satoshi created the first block of Bitcoin in the beginning, called the Genesis block.

%20(1)%20(1).png)

The fairest way of doing seigniorage

The Genesis block is special in so far as this block was initially mined by Satoshi to get Bitcoin off the ground. Satoshi also included a message in the Genesis Block as a “proof of no premine.” This message was taken from the front page of the British newspaper The Times.

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

Satoshi released Bitcoin's whitepaper to the cypherpunk community on October 28, 2008, 2 months before mining the Genesis block. At the time Satoshi was only reaching out to the only other people who would possibly be interested in experimenting with a sovereign decentralized digital currency at the time, the cypherpunks.

The code to mine Bitcoin was available on the day Satoshi began mining, making it theoretically possible for other people to mine Bitcoin from its second block onwards.

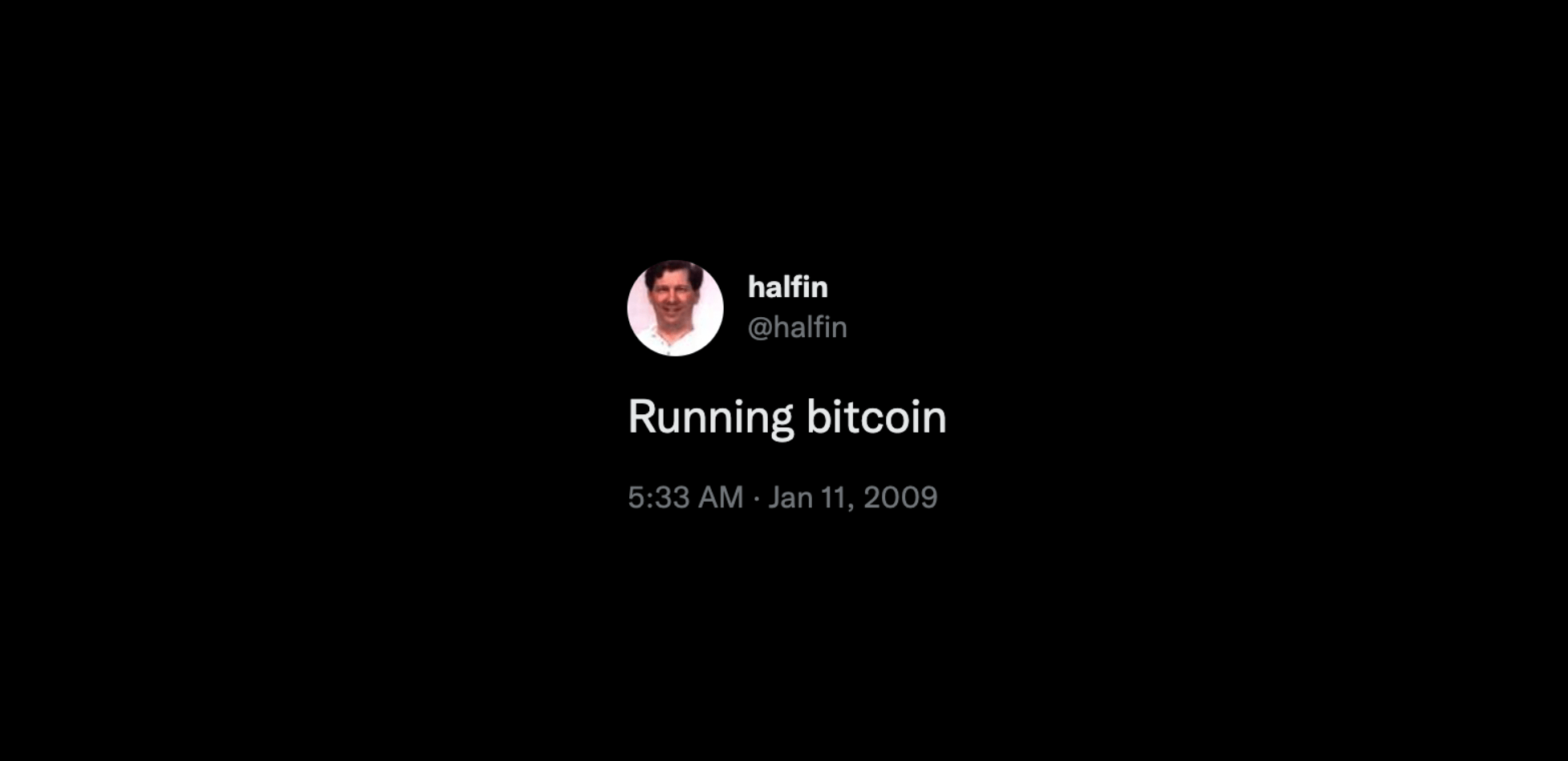

The first person to actively join Satoshi in mining was Hal Finney, who started running Bitcoin on January 11, 2009, 8 days after Bitcoin's launch.

Proof of Work mining as a form to distribute Bitcoin seems like an intentional decision Satoshi took.

Satoshi could have also distributed bitcoins to friends and special interest organizations after having mined all the bitcoin privately in advance. Such a procedure is referred to as a "premine".

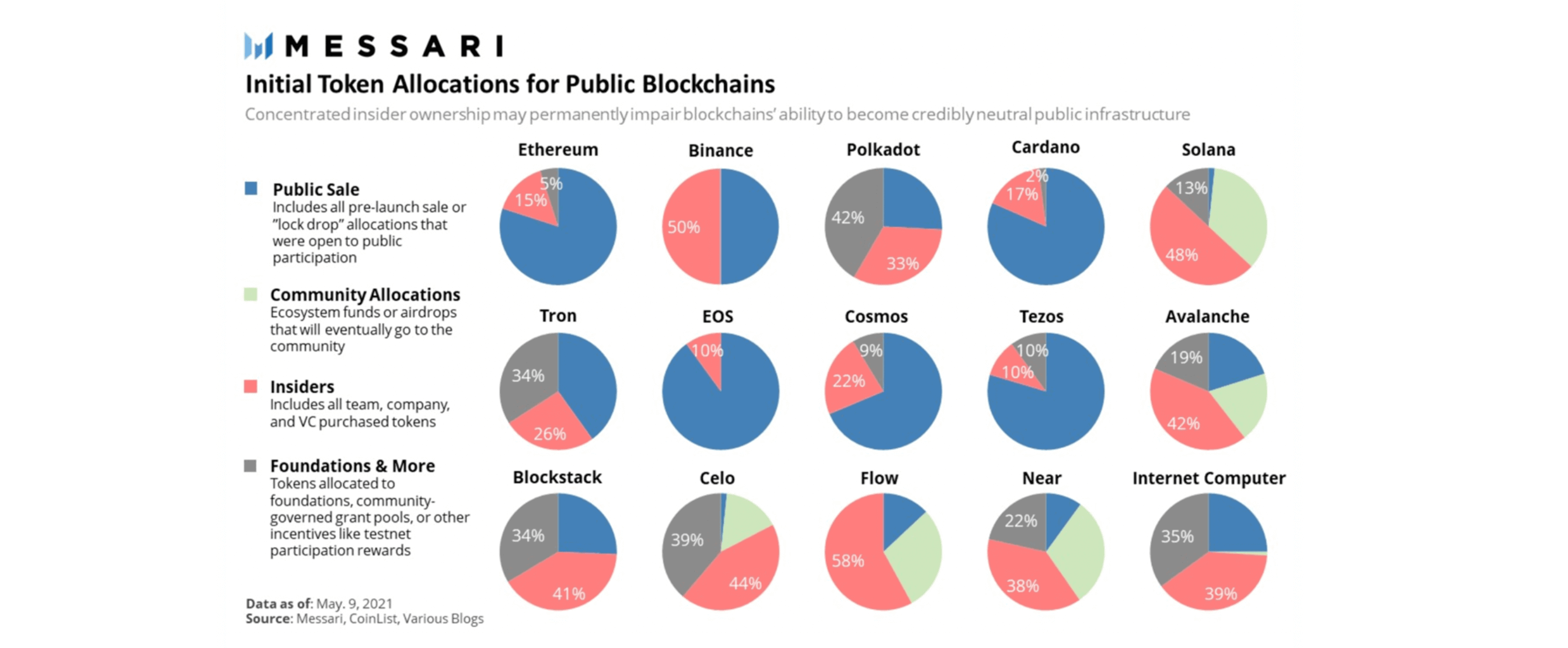

As a matter of fact, most crypto projects today are pre-mined and distributed to people through different investment rounds.

By choosing not to pre-mine Bitcoin, Satoshi opted for a form of distribution that would make Bitcoin only available on the open free market.

To this day, Bitcoin can only be bought at market prices or mined through expending energy in the form of electricity.

Early miners have had an advantage over today's market participants in that they were able to obtain bitcoin at much lower prices. However, this is not making things unfair. The earlier one got involved in Bitcoin, the greater the risks were associated with mining bitcoin and holding it as an asset.

To date, it seems uncontroversial to consider the process of open, accessible mining one of the fairest ways to distribute a cryptocurrency. But not only can Proof of Work mining be considered fair, but it also fosters organic growth of Bitcoin as a monetary system as the only ones who got ahold of bitcoin, had to incur a cost to do so.

The blessing of having been anonymity

Obviously, Proof of work mining can be (and has been) adopted by other cryptocurrencies as well. However, no other cryptocurrency that was launched after Bitcoin was truly able to launch in an environment without the concept of cryptocurrencies not already being a "thing".

In that regard, Bitcoin truly launched from a clean slate.

This very underrated fact ties in with another underrated but crucial element of Bitcoin’s immaculate conception: Bitcoin had no market value when it started. Nic Carter, one of Bitcoin’s most astute thinkers, summarized this perfectly when he said:

“Bitcoin benefited from an extremely rare set of circumstances. Because it launched in a world where digital cash had no established value, they circulated freely. That can’t be recaptured today since everyone expects coins to have value. Not only was it fair, but it was historically unique in its fairness. The immaculate conception.”

Because no one was expecting Bitcoin to have any success at all – apart from a few anarchist computer engineers – no one of systemic importance really cared to acquire it.

In that regard, Bitcoin is fundamentally different from other cryptocurrencies. Most cryptocurrencies that launch today, come with specific a public sale price – so expectations are that this new type of cryptocurrency has a value attached to it from the get-go.

With Bitcoin, however, virtually no investors in the real sense of the word were speculating on Bitcoin’s value after its launch.

There were no VCs that were given special access to buy up bitcoin. As new cryptocurrencies came onto the scene after bitcoin had laid the groundwork behind the basic concept, this began to change quickly.

Given that a new crypto project carries any merit upfront, media attention is guaranteed with venture capitalist funds eagerly getting their share of the token through participating in a private sale.

When it comes to a globally accepted, politically neutral money such a situation is undesirable.

Once private interests of any kind are involved, general confidence in the neutrality of this newly created money is lost. Users, in the long run, won't trust a project that had centralized control over token distribution and allocation to special interest groups purely as a way of fundraising for the project.

Bitcoin (red line) plotted against the next 118 popular cryptocurrencies. Data via Woodbull

While there are different people who profit from other people’s usage of bitcoin today, this fact is the result of organic, unblemished growth over time, rather than cryptocurrency is able to go through today.

Immaculacy produces the purest narrative

At this point, the question arises: Why is the fact of immaculate conception so important?

Immaculate conception creates the purest narrative, which is a prerequisite for trust to be established.

Surely, for a new globally accepted, politically neutral money to achieve mass adoption, users ultimately have to trust it.

In order for any trust to grow, the characteristics of sound and compelling money have to be present. While it is rather easy to technically implement and optimize these as discussed earlier, credibly maintaining them in a trust-minimized way is the real challenge.

Only then can trust in the true neutrality of this money really grow.

Although it cannot be ruled out that any other cryptocurrency could be accepted as a globally accepted, politically neutral money, the odds are heavily in favor of Bitcoin.

Being of the most immaculate conception among cryptocurrencies, Bitcoin is the most convincing contender to truly become a globally accepted, politically neutral money.